The standby charge is an important tax concept, particularly when a business provides a vehicle to an employee or owner for personal use. In certain jurisdictions, such as Canada, the standby charge applies when a corporation provides an employee or business owner with a company-owned or leased vehicle that is available for personal use. This charge must be included in the employee’s income as a taxable benefit.

What is a Standby Charge?

The standby charge is a tax mechanism applied by the Canada Revenue Agency (CRA) to calculate the taxable benefit of personal use of a company-owned or leased vehicle. The charge is meant to reflect the value of the benefit the employee or business owner receives from having the vehicle available for personal use.

When is the Standby Charge Applied?

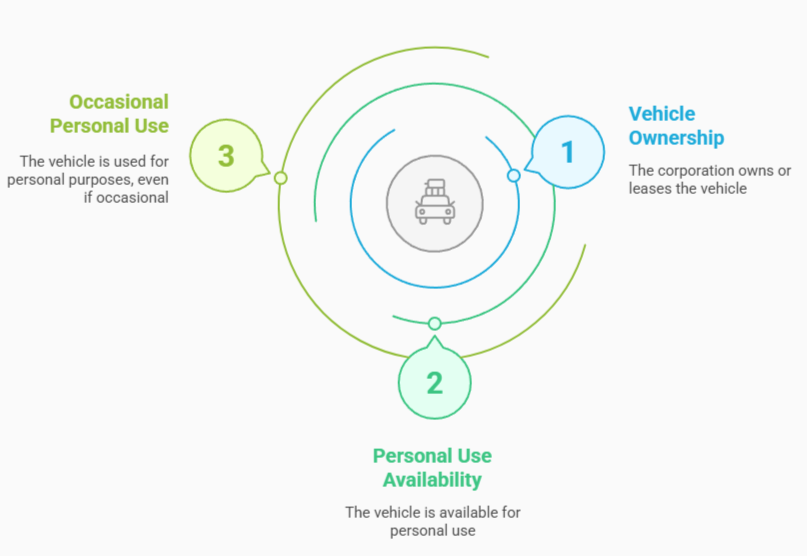

The standby charge applies when:

- The corporation owns or leases the vehicle.

- The vehicle is available for the personal use of an employee, shareholder, or business owner.

- The employee or shareholder uses the vehicle for personal purposes, even if it’s just occasional use.

If the vehicle is used exclusively for business purposes, there is no standby charge. However, if there’s personal use, even on an occasional basis, the standby charge is assessed.

How is the Standby Charge Calculated?

The standby charge is based on either the cost of the vehicle or its lease cost, depending on how the vehicle is financed. Here’s how each is calculated:

For a Financed Vehicle (Company-Owned)

- The standby charge is based on the original cost of the vehicle (including taxes and other related costs) and is calculated as a percentage of the vehicle’s cost.

- The formula for the standby charge is: Standby Charge = 2% × Original Cost of the Vehicle × Number of Months Available. The charge applies for each month the vehicle is available to the employee or shareholder for personal use. So, if the vehicle is available for 12 months, the charge will be based on 12 months of availability.

- Example: If a vehicle costs $30,000 and is available for 12 months, the annual standby charge will be: 2% × 30,000 × 12 = $7,200 per year

For a Leased Vehicle

- The standby charge for a leased vehicle is based on the lease cost rather than the vehicle’s purchase cost.

- The formula for the standby charge is: Standby Charge = (2/3) × Monthly Lease Payment × Number of Months Available. If the vehicle is leased, the charge is calculated by taking two-thirds of the monthly lease payment and multiplying it by the number of months the vehicle is available.

- Example: If the lease payment is $500 per month and the vehicle is available for 12 months, the standby charge will be: (2/3) × 500 × 12 = $4,000 per year

Adjustments to the Standby Charge

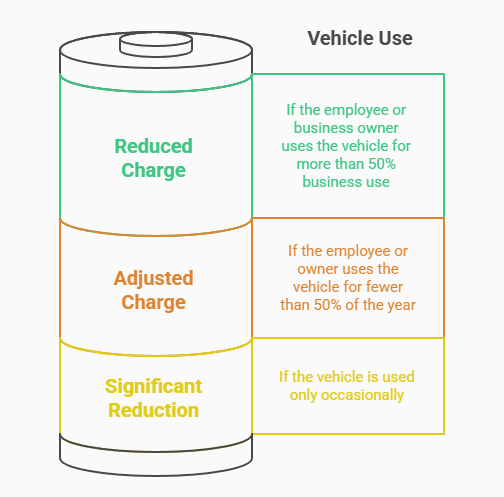

The standby charge may be reduced if the vehicle is used primarily for business. If the employee or business owner uses the vehicle for more than 50% business use, the standby charge may be reduced based on the proportion of business use. For example, if the vehicle is used 60% for business and 40% for personal use, the personal use portion of the standby charge would be calculated based on the 40% use.

The formula for the business-use reduction is:

Standby Charge Reduction = Standby Charge × Percentage of Personal Use

If the employee or owner uses the vehicle for fewer than 50% of the year, the standby charge might be adjusted based on the actual period the vehicle was available for personal use. If the vehicle is used only occasionally, the reduction can be more significant.

Taxable Benefit and Reporting

The standby charge is considered a taxable benefit and must be included in the employee’s or business owner’s income. The business will need to report this benefit on the employee’s T4 slip (in Canada) or similar form in other jurisdictions. The taxable benefit is added to the employee’s income and taxed at their personal tax rate.

Interaction with the Operating Expense (Operating Cost Benefit)

In addition to the standby charge, a separate operating cost benefit may be assessed for the personal use of the company vehicle. This operating cost benefit is based on the costs incurred by the business to maintain and operate the vehicle, including:

- Fuel

- Maintenance

- Insurance

- Repairs

The operating cost benefit is typically calculated as a flat amount per month or based on actual vehicle expenses. If the business covers these costs for personal use, this amount is added to the employee’s taxable income.

How is the Operating Cost Benefit Calculated?

For personal use of a company vehicle, the operating cost benefit is generally calculated as:

- $0.28 per kilometer (in Canada for 2023) for personal kilometers driven.

- Alternatively, a fixed monthly amount can be assigned based on the actual operating costs of the vehicle.

This is typically added to the employee’s income for the year, and the business can claim the operating costs as a deductible expense.

Key Points to Remember About Standby Charges:

- Primarily Business Use: If the vehicle is used more than 50% for business, the standby charge can be reduced accordingly.

- Personal Use: The standby charge applies whenever a company vehicle is available for personal use, even if it’s used occasionally.

- Lease vs. Purchase: The standby charge differs between a company-owned (purchased) vehicle and a leased vehicle, with the charge for a leased vehicle being based on the lease payments.

- Taxable Benefit: The standby charge is a taxable benefit and must be reported as income. The business must track the personal use of vehicles to calculate this benefit accurately.

Conclusion

The standby charge is a taxable benefit when a company vehicle is available for personal use, even occasionally. The amount depends on how the vehicle is financed or leased and the split between business and personal use. Contact us today to minimize tax liability and ensuring compliance.