Deciding whether to incorporate or remain a sole proprietor is a key decision that depends on your goals, risk tolerance, and finances. While sole proprietorship offers simplicity, incorporation provides benefits like limited liability, tax planning opportunities, and greater growth potential. This blog breaks down the pros and cons to help you choose what’s best for your business. Let’s dive in!

What Are the Differences Between Sole Proprietorship and Incorporation?

Sole Proprietorship:

- Definition: A sole proprietorship is the simplest form of business. You and your business are considered the same legal entity.

- Liability: As a sole proprietor, you are personally responsible for any debts, legal actions, or obligations incurred by your business. Your personal assets (home, car, savings) could be at risk if the business faces financial or legal issues.

- Taxation: Business income is reported on your personal tax return. All profits are taxed as personal income at your personal tax rate. Higher profits mean higher taxes.

- Costs: Low setup and maintenance costs. No need for a separate tax return. Generally simple and inexpensive to manage.

- Flexibility: Ideal for smaller, low-risk businesses or hobbies. You maintain full control of decision-making.

Corporation:

- Definition: A corporation is a separate legal entity from its owner(s). It has its own rights and responsibilities, distinct from the individuals who own it.

- Liability: A corporation offers limited liability protection. Your personal assets are generally shielded from business liabilities, meaning only corporate assets are at risk if the business faces legal action or debt (unless you’ve personally guaranteed debts or acted fraudulently).

- Taxation: Corporations are taxed separately from personal income. In Canada, small businesses benefit from the Small Business Deduction (SBD), which allows for a lower corporate tax rate (usually 9-12% on the first $500,000 of income). Retained earnings are taxed at a lower corporate rate, with personal taxes only triggered when funds are withdrawn through salary or dividends. Keep in mind, eligible and non-eligible dividends have different personal tax implications.

- Costs: Higher setup and maintenance costs. You must file a separate corporate tax return, maintain legal records, and possibly pay for additional services (e.g., accountants or legal professionals).

Here is a quick summary table:

| Considerations | Sole Proprietorship | Incorporation |

| Definition | You and your business are the same legal entity. | Separate legal entity from the owner(s). |

| Liability | Personal assets are at risk for business debts or legal issues. | Personal assets are generally protected; only corporate assets are at risk. |

| Taxation | Business income is taxed as personal income at your personal tax rate. | Lower corporate tax rates (9–12% in Canada); personal taxes apply only when withdrawing money. |

| Costs | Low setup and maintenance costs. | Higher setup and ongoing costs (e.g., legal, accounting, separate tax return). |

| Flexibility | Simple structure; full control; ideal for hobbies or low-risk, small businesses. | Structured for growth, investors, and employees; better for larger-scale or growing businesses. |

| Risk Management | Personal liability for GST, loans, and business obligations. | Reduced personal liability; corporation shields personal assets from most business risks. |

What Are Key Considerations for Sole Proprietors?

Liability Concerns: As a sole proprietor, your personal assets are at risk if the business faces lawsuits or financial trouble. For example, if you owe taxes (like GST) or take out loans that the business can’t repay, you may be personally responsible for settling these debts.

GST and Loans: If you collect GST/HST on behalf of the CRA and fail to remit it, you are personally liable. Similarly, if your business takes out a loan, you could be personally responsible for repaying it if the business defaults.

Personal Risk Management: If your business is a low-risk hobby or generating minimal revenue, the risk might be manageable. However, as your business grows, or if you provide professional services or advice, the risks may increase.

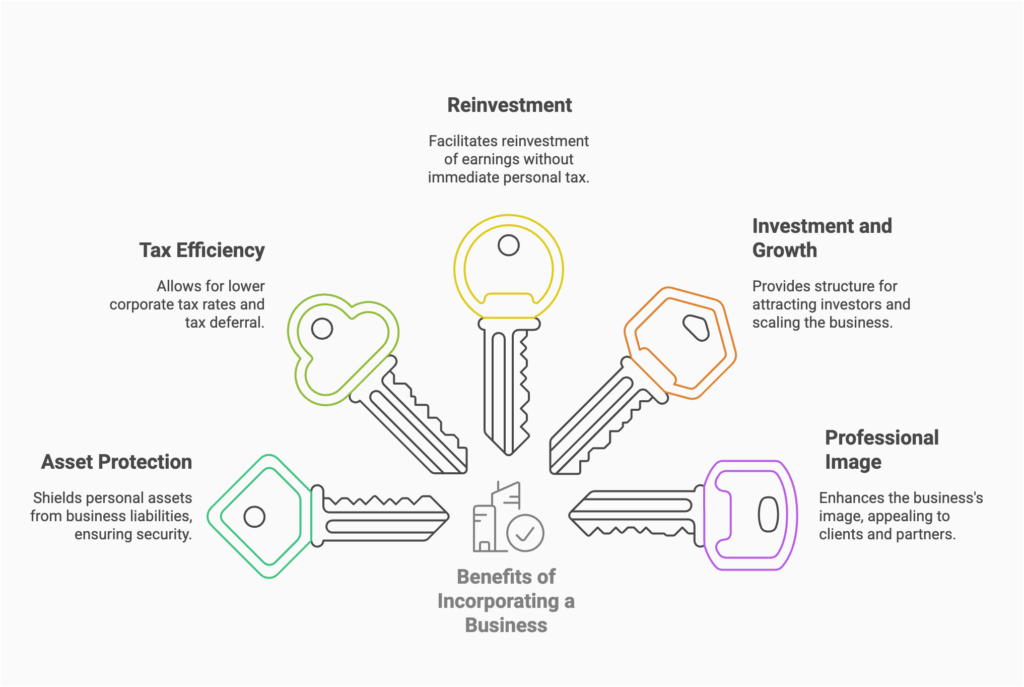

What Are Key Considerations for Incorporation?

Protecting Personal Assets: Incorporating shields your personal assets from business liabilities, providing more security if your business faces financial issues or lawsuits. Only the corporation’s assets are at risk. Only the corporation’s assets are at risk. Learn more about Annual Requirements for a Corporation in BC.

Tax Efficiency: If your business generates consistent revenue, incorporating allows you to benefit from lower corporate tax rates and the ability to defer taxes by leaving earnings in the corporation. You only pay personal taxes when you withdraw money.

Reinvestment: Corporations allow you to reinvest retained earnings into the business without immediate personal tax implications, which is beneficial for growth. In a sole proprietorship, you would pay personal tax on all profits, even if you don’t withdraw the money.

Investment and Growth: If you plan to scale your business, attract investors, or issue shares to raise capital, incorporating is necessary. It offers more structure for investment opportunities and growth management. Learn more about How to Create Pro Forma Financial Statements to help plan for expansion.

Professional Image: Incorporating may improve your business’s professional image, especially if you plan to expand or work with clients who prefer dealing with incorporated businesses.

What Are the Considerations for a Hobby or Small Business?

A hobby is pursued for personal enjoyment, while a business is operated with the intention of making a profit. To explore the key differences in more detail, check out our full blog.

Small Scale: If your business is currently a hobby or generates low revenue, the simplicity and cost-effectiveness of a sole proprietorship might make sense. Incorporating may not be worthwhile at this stage if you’re not taking on significant risks or planning for large-scale growth.

Administrative Burden: Incorporation involves more paperwork, legal requirements, and administrative tasks (e.g., filing a separate tax return, keeping corporate records). If you’re just doing this as a hobby or side business, these added responsibilities may not be worth it. If you want to learn how to stay on top of financial organization, read What Is a Month-End Close Process for Accounting?.

Liability Protection Needs: If your business is low-risk (e.g., you’re not providing high-risk services or entering into contracts), the liability protection offered by a corporation may not be necessary. However, if your business is growing or you’re dealing with clients, it’s worth considering for added protection.

Key Questions to Ask Yourself

What’s the scale of my business? If your business is small and low-risk, staying a sole proprietor is simple and effective.

Do I need liability protection? If your business involves any form of risk, such as offering professional advice, handling sensitive data, or engaging in contracts, incorporation may be beneficial for protecting your personal assets.

Am I planning to grow? If you’re thinking about expanding, attracting investors, or hiring employees, incorporation provides more flexibility and opportunities for growth.

How much money am I making? If your business starts generating substantial income, the tax benefits of incorporation (lower corporate tax rates and the ability to reinvest earnings) could outweigh the costs and complexity.

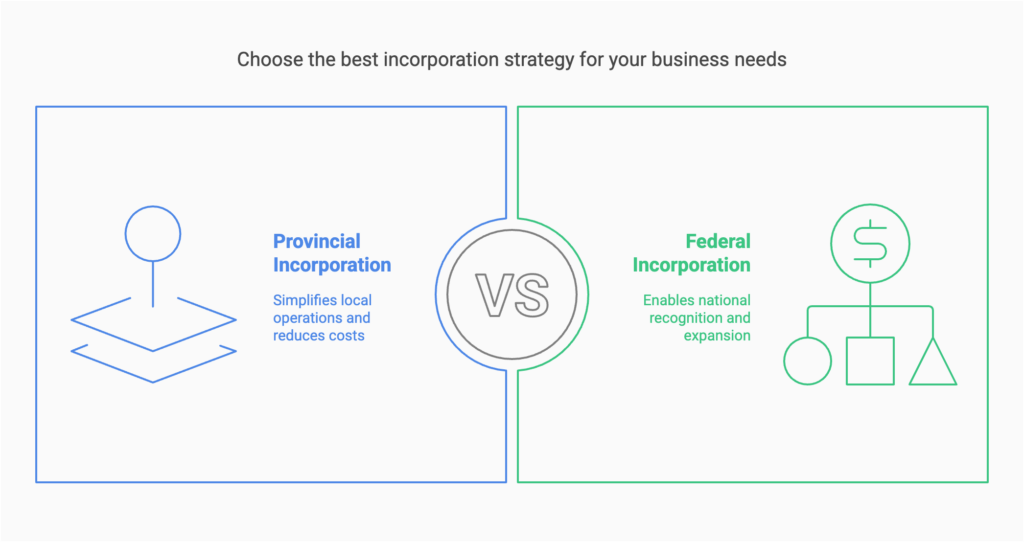

What Are the Differences Between Provincial and Federal Incorporation?

When incorporating a business in Canada, you can choose between provincial and federal incorporation. Provincial incorporation means your business is registered in a specific province, and you must comply with that province’s regulations. Federal incorporation allows you to operate under Canadian law nationwide, providing broader recognition across provinces. If your business plans to operate only within one province, provincial incorporation may be simpler and more cost-effective. However, if you plan to expand across Canada or need national recognition, federal incorporation might be the better option.

Can I Incorporate Myself or Should I Use a Lawyer?

Incorporating a business can be done independently through online platforms or by filing the required paperwork directly with government agencies. However, working with a lawyer can help ensure your incorporation is handled correctly, especially when drafting the articles of incorporation, bylaws, and other legal documents. Lawyers can also advise on selecting the right structure, shareholder agreements, and other important legal considerations. If your business is straightforward and you understand the process, incorporating yourself is an option, but a lawyer may be beneficial for more complex needs.

Conclusion

Whether you’re a small business owner or an aspiring entrepreneur, navigating the complexities of incorporation requires informed decision-making. The structure of the business, the size of the business, and the long-term goals of the business will all play a role in determining whether incorporating is the right choice.

While each business has unique needs, our team is equipped to guide you through this process. Reach out to us today to explore how we can assist you in achieving your business objectives effectively.