Did you know you can safeguard your business’s financial future with pro forma financial statements? This powerful tool helps project future performance and assess the impact of key decisions, giving you greater control over your business’s success.

In this guide, we’ll walk you through the essential steps—defining purpose, gathering data, identifying assumptions, and analyzing results. Since accuracy is key, consulting a professional can help you make the most of your projections. Let’s dive in.

What Are Pro Forma Financial Statements?

Pro forma financial statements are projections or estimates of your business’s financial performance based on certain assumptions or hypothetical scenarios. They are not historical records but are instead forecasts of what your financial position might look like in the future, allowing you to plan for different outcomes and make data-driven decisions.

The main types of pro forma statements include:

- Pro Forma Income Statement: A projection of your revenues, expenses, and profits over a certain period.

- Pro Forma Balance Sheet: A forecast of your company’s assets, liabilities, and equity at a specific point in the future.

- Pro Forma Cash Flow Statement: A projection of your business’s cash inflows and outflows, helping you understand how changes in your operations might affect liquidity.

These projections are typically used for business planning, securing funding, and exploring new business opportunities.

Difference Between Pro Forma, Budget, Forecast, Financial Statements, and Tax Return

Pro forma financials are projections based on assumptions about future scenarios, while other financial documents like budgets, forecasts, and financial statements are used to track performance and plan for the future in different ways. Below is a breakdown of how these documents differ.

| Document | Purpose | Timeframe | Data Type | Key Features |

| Pro Forma | To forecast future financial performance based on assumptions | Future projections (1+ years) | Hypothetical scenarios or assumptions | Used for planning new ventures, securing funding, or evaluating different business strategies. |

| Budget | To plan and allocate resources for the future | Typically within 1 year | Expected revenues and expenses | A detailed plan for managing income and expenses, usually set at the start of the year based on historical data and goals. |

| Forecast | To predict future performance based on past trends | Future projections (quarterly/yearly) | Data-driven estimates based on trends | More flexible than a budget; adjusted over time based on changing conditions. |

| Financial Statements | To show actual past financial performance | Historical (previous year or quarter) | Actual income, expenses, assets, and liabilities | Includes Income Statement, Balance Sheet, and Cash Flow Statement. Reflects how the business has performed in the past. |

| Tax Return | To report actual income and taxes owed | Historical (previous year) | Actual income, deductions, and tax obligations | Filed with the government; legally required and used to determine tax liabilities based on real performance, not projections. |

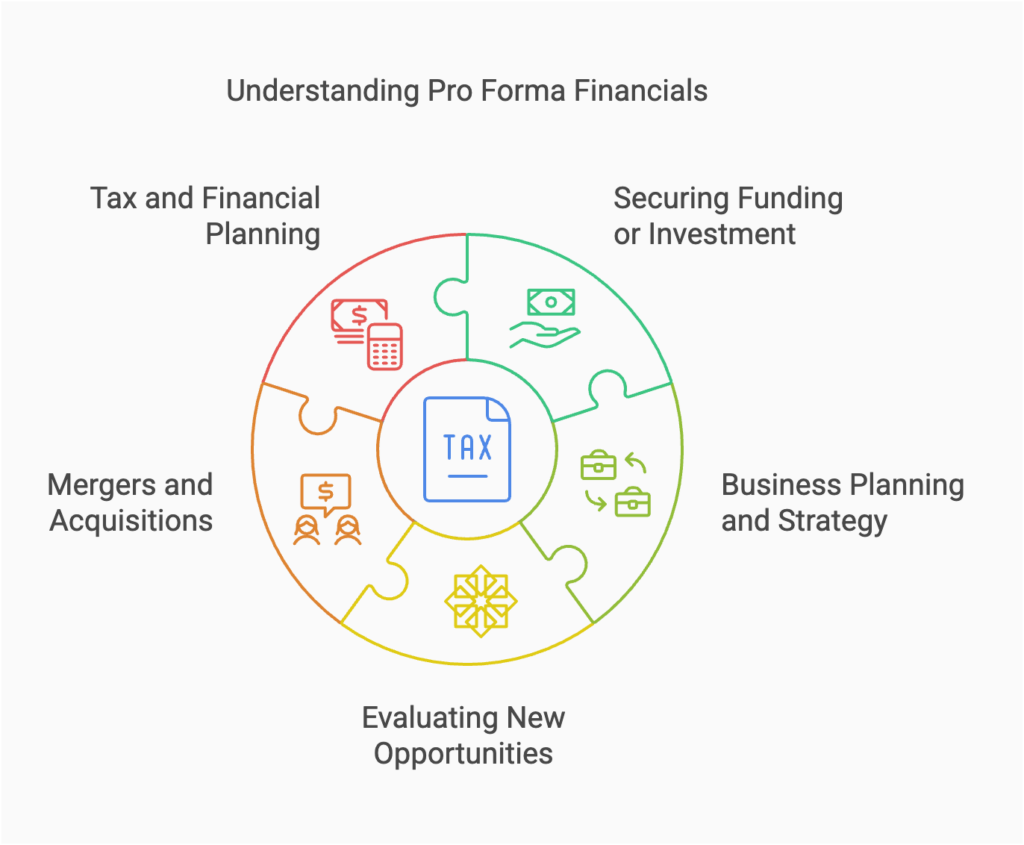

When Does a Business Owner Require a Pro Forma?

As a small business owner, you’ll need pro forma financial statements in several key situations:

- Securing Funding or Investment: If you’re seeking loans or attracting investors, pro forma financials help demonstrate the potential financial success of your business or a new project.

- Business Planning and Strategy: When developing business plans, pro forma statements allow you to forecast how new strategies, product launches, or market expansions will impact your bottom line.

- Evaluating New Opportunities: Pro forma financials are helpful when evaluating new ventures, whether it’s opening a new location or diversifying your product line.

- Mergers and Acquisitions: When contemplating a merger or acquisition, pro forma financials show how the combined company would perform financially.

- Tax and Financial Planning: Preparing for potential tax changes or understanding future tax liabilities can be aided by creating pro forma statements. Learn more about tax planning tips.

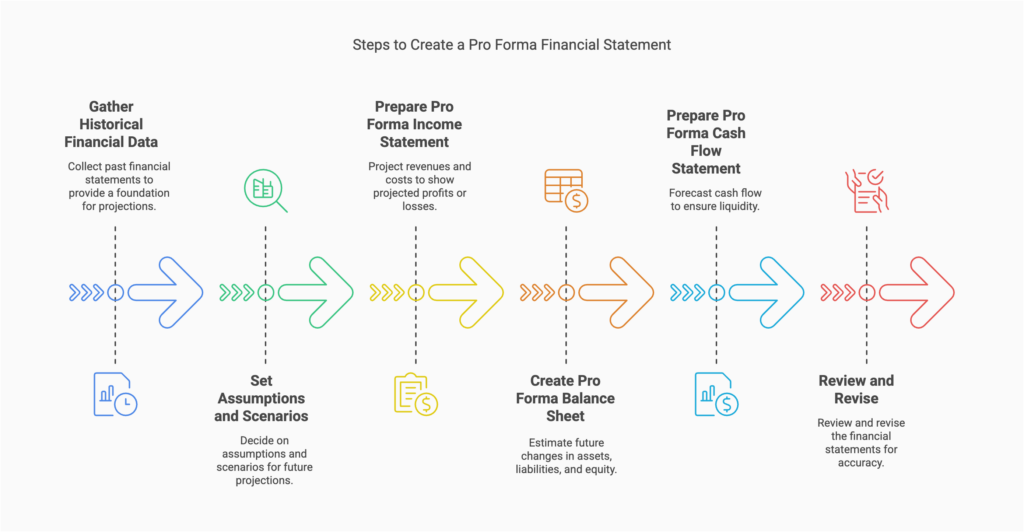

Steps to Create a Pro Forma

Creating a pro forma financial statement involves several key steps:

- Gather Historical Financial Data: Start by gathering your business’s past financial statements (income statement, balance sheet, and cash flow statement). This provides a foundation for your projections.

- Set Assumptions and Scenarios: Decide on the assumptions you want to include in your pro forma. For example, if you plan to launch a new product, estimate how much it will increase your revenue, what expenses it will incur, and when it will break even.

- Prepare Your Pro Forma Income Statement: Project your revenues, cost of goods sold, operating expenses, and other costs based on your assumptions. This will show your projected profits or losses.

- Create the Pro Forma Balance Sheet: Estimate how your assets, liabilities, and equity will change in the future based on your new business strategies or scenarios.

- Prepare the Pro Forma Cash Flow Statement: Forecast how cash will flow in and out of your business based on your revenue projections and expenses. This helps ensure you have enough liquidity to cover future costs.

- Review and Revise: Once you’ve completed the initial draft of your pro forma financials, review them to ensure the assumptions and projections are reasonable. Revise them as needed based on your business insights.

How Can My Bookkeeper and/or Accountant Assist with Creating a Pro Forma?

Your accountant and/or bookkeeper can be invaluable when creating pro forma financials:

- Data Collection: Your bookkeeper can help organize and gather historical financial data, ensuring your projections are based on accurate information.

- Assumption Development: An accountant can help you set reasonable assumptions, based on industry data or their expertise, ensuring your pro forma statements are grounded in reality.

- Projection Models: Accountants can create detailed financial models based on your assumptions, ensuring the projections align with your business goals and financial constraints.

- Sensitivity Analysis: They can assist in testing different scenarios, helping you understand how changes in key variables (e.g., sales growth, cost reductions) might affect your financial outlook.

- Compliance and Accuracy: Both your accountant and bookkeeper can ensure that your pro forma statements are in line with accounting standards, and they can help ensure the statements are credible and presentable to investors or lenders.

By collaborating with your financial professionals, you can ensure your pro forma financials are realistic, accurate, and aligned with your business goals. Learn how our services can support your business.

Conclusion

Pro forma financial statements are essential for planning, securing funding, and evaluating strategic decisions. Understanding how they differ from budgets, forecasts, and tax returns ensures you’re using the right tools.

Whether you’re planning growth, navigating a merger, or exploring new opportunities, working with an accountant can help you create accurate pro forma statements to guide your decisions.

Need assistance? Reach out to us today for expert support!