CRA audits are rarely random. In 2026, the Canada Revenue Agency continues to rely heavily on data matching, industry benchmarking, and cross checking between tax filings to identify audit targets.

For Canadian business owners, this means audits are increasingly triggered by patterns that look unusual or inconsistent, even when returns are filed on time and taxes are paid. This blog uncovers some of the top CRA audit triggers and CRA audit red flags in 2026, with a focus on the issues business owners often overlook and how to avoid a CRA audit.

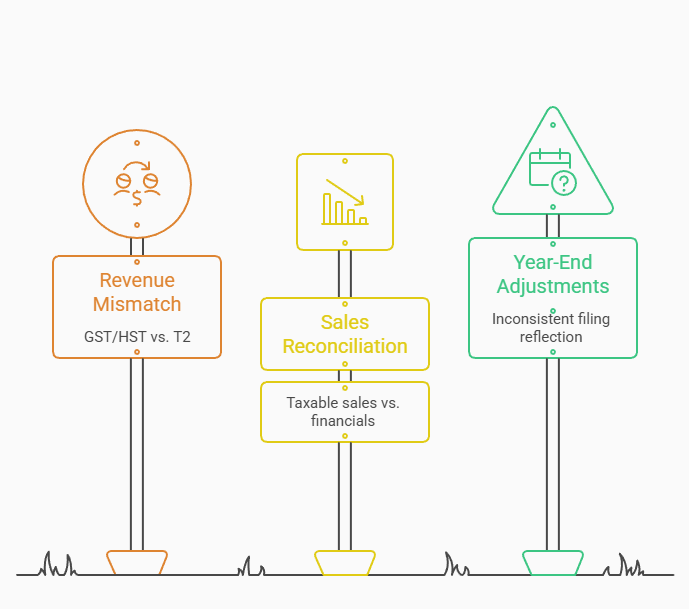

CRA audit red flags when GST HST revenue does not match corporate tax filings

One of the most common and highest risk CRA audit triggers is inconsistent revenue reporting across tax filings.

CRA audit red flags include:

- Revenue reported on GST/ HST returns that does not match the T2 corporate tax return

- Taxable sales that do not reconcile to financial statements

- Year end adjustments reflected in one filing but not others

In 2026, CRA systems are increasingly automated. Revenue mismatches are often flagged electronically before a file is ever reviewed by an auditor.

Unreasonable expenses compared to revenue or similar businesses

The CRA routinely compares your expense ratios to:

- Prior years

- Businesses of similar size

- Others in your industry

Expenses that grow faster than revenue or sit well above industry benchmarks are a key CRA audit trigger. Even fully receipted expenses can be challenged if they do not appear reasonable for the level of business activity. This is one of the most common CRA audit red flags for owner managed corporations.

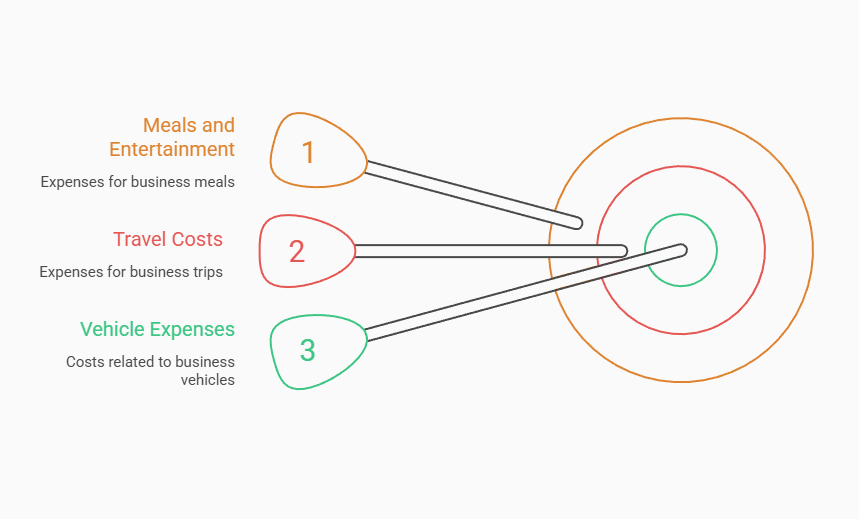

Automobile, travel, and meals and entertainment expenses under CRA review

Certain expense categories are consistently among the top CRA audit triggers, particularly:

- Vehicle expenses

- Travel costs

- Meals and entertainment

These expenses frequently involve mixed personal and business use. In 2026, CRA auditors continue to focus on overstated business use percentages, inconsistent claims year over year, and missing or vague documentation. Meals and entertainment expenses are also subject to limits. In most cases, only 50 percent is deductible. Excessive claims relative to revenue often lead to expanded audits.

This is often the point where business owners realize their bookkeeping has never been reviewed through a CRA audit risk lens. Proactive cleanup before filing can materially reduce audit exposure and prevent a small review from turning into a broader audit.

Contractor versus employee classification as a CRA audit trigger

Worker misclassification remains a major CRA audit focus in 2026.

CRA audit red flags include:

- Contractors working exclusively for one business

- Long term relationships with no other clients

- Set hours, tools provided, and ongoing supervision

If the CRA reclassifies a contractor as an employee, the business may owe CPP, EI, penalties, and interest going back several years.

Missing or inconsistent T slips flagged by the CRA

T slips are one of the CRA’s primary cross checking tools.

Common CRA audit triggers include:

- Missing T4s, T5s, or T4As

- Slips that do not match payroll or expense accounts

- Late or repeatedly amended slips

CRA systems automatically compare slips to personal tax returns, making mismatches easy to identify.

Claiming non deductible expenses as business deductions

Claiming non deductible expenses is a quieter but common CRA audit red flag.

Frequently challenged expenses include:

- CRA interest and penalties

- Traffic tickets and other fines

- Golf club dues and initiation fees

- Political contributions

- Interest on personal income tax balances

- Life insurance premiums, even when required by a lender or paid by a corporation

Repeated errors in this area often cause the CRA to expand the scope of an audit.

Shareholder loans that remain outstanding year after year

Shareholder loan balances are a growing CRA audit focus for owner managed corporations.

CRA audit red flags include:

- Large debit balances owed by shareholders

- Loans outstanding beyond one year

- No repayment plan or supporting documentation

If not managed correctly, shareholder loans can be included in personal income even if no cash changes hands.

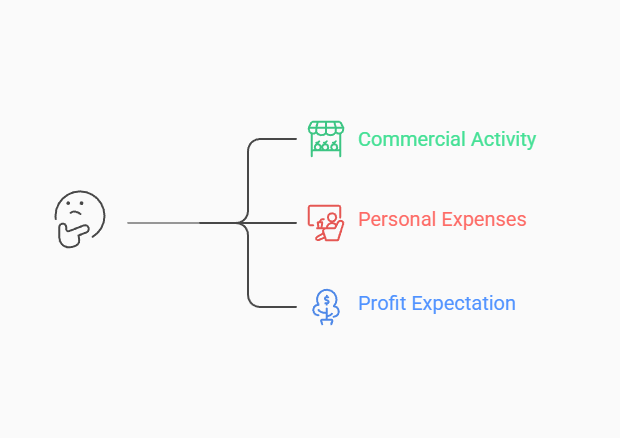

Business losses over multiple years and CRA audit risk

Reporting losses for several consecutive years increases CRA audit risk, especially in closely held businesses.

The CRA may question whether:

- The activity is truly commercial

- Expenses are personal in nature

- There is a reasonable expectation of profit

This remains a common CRA audit trigger in 2026 for side businesses and lifestyle businesses.

Paying spouses or children above market rates

Hiring family members is permitted, but compensation must be reasonable.

CRA audit red flags include:

- Wages exceeding market rates

- Poor documentation of job duties

- Compensation increases without a change in responsibilities

Unreasonable compensation can be denied as a deduction.

Personal portion of mixed use expenses overstated

Mixed use expenses are one of the most frequently adjusted items in CRA audits.

Common problem areas include:

- Home office expenses

- Cell phone and internet

- Utilities

- Vehicles used for both business and personal purposes

Claiming 100 percent business use without proper support is a consistent CRA audit red flag.

Large or unusual charitable donations claimed by corporations

Charitable donations are deductible, but large donations relative to income can attract CRA attention.

CRA audit triggers include:

- Significant year over year fluctuations

- Donations that do not align with cash flow

- Poor coordination between corporate and personal donation strategies

How to avoid a CRA audit and reduce audit risk in 2026

While no business can eliminate CRA audit risk entirely, most audits are preventable or manageable with the right processes.

Key ways to reduce CRA audit risk include:

- Maintaining accurate, up to date bookkeeping with monthly reconciliations

- Ensuring GST HST, payroll, and corporate tax filings reconcile to each other

- Taking reasonable and defensible positions on deductions

- Properly documenting mixed use and related party transactions

- Filing all returns on time, even if payment is not immediately possible

- Working with advisors who understand current CRA audit patterns

In 2026, consistency and documentation matter more than ever.

Frequently asked questions about CRA audits

Q: What are the top CRA audit triggers in 2026?

A: Revenue mismatches, unreasonable expenses, contractor misclassification, missing T slips, and shareholder loans remain the most common triggers.

Q: Are CRA audits random or targeted?

A: Most CRA audits are targeted and data driven, not random.

Q: Does claiming a GST HST refund increase CRA audit risk?

A: Large or recurring refunds can increase scrutiny, particularly when revenue is flat or declining.

Q: How far back can the CRA audit a business?

A: Typically three to four years, but longer where negligence or misrepresentation is alleged.

Q: How can I avoid a CRA audit as a business owner?

A: Clean bookkeeping, consistent filings, reasonable deductions, and proactive tax planning significantly reduce audit risk.

Conclusion

CRA audits are rarely triggered by one single mistake. They are usually the result of multiple small issues that, together, create CRA audit red flags. Strong bookkeeping, clean reconciliations, and defensible tax positions significantly reduce audit risk and make audits far easier to manage if one occurs.

At Purpose CPA, we help Canadian business owners reduce CRA audit risk through accurate bookkeeping and proactive tax planning. If you’re unsure whether your filings would stand up to review, it’s far easier—and less costly—to address it now than during an audit. Contact us to get clarity and stay ahead.