Did you know that the Allowable Business Investment Loss (ABIL) in Canada lets you deduct 50% of losses from failed small business investments against any type of income? This valuable tax provision offers significant relief for investors and entrepreneurs facing financial setbacks.

In this blog, we’ll break down how ABIL works, its eligibility criteria, tax implications, and key filing requirements. Backed by expert insights, we’ll also explore common CRA challenges and strategies to maximize your claim.

By the end, you’ll understand how to determine if your investment qualifies, navigate the income generation requirement, and leverage ABIL for tax savings. Let’s dive in.

What is ABIL?

ABIL is a unique tax deduction that applies when you incur a loss from:

- Selling or disposing of shares or debt in an SBC at a loss.

- A deemed disposition, such as bankruptcy, insolvency, or business closure.

Key Features of ABIL:

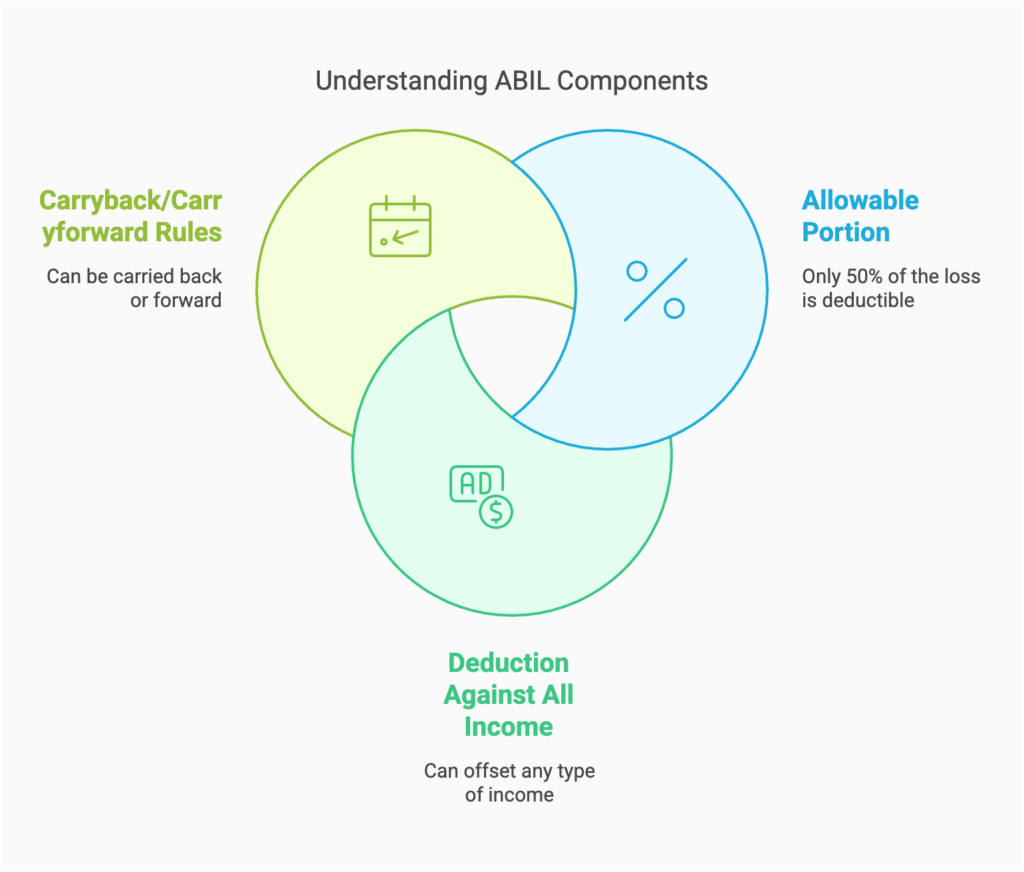

- Allowable Portion: Only 50% of the loss is deductible, similar to capital gains/losses.

- Deduction Against All Income: Unlike regular capital losses, ABIL can offset any type of income, such as employment, rental, or interest income.

- Carryback / Carryforward Rules:

- Unused ABILs can be carried back three years or forward ten years.

- After ten years, any remaining ABIL converts into a regular capital loss.

Setting a company’s year-end can also maximize tax benefits.

The Tax Advantage: Deducting ABIL Against Any Income

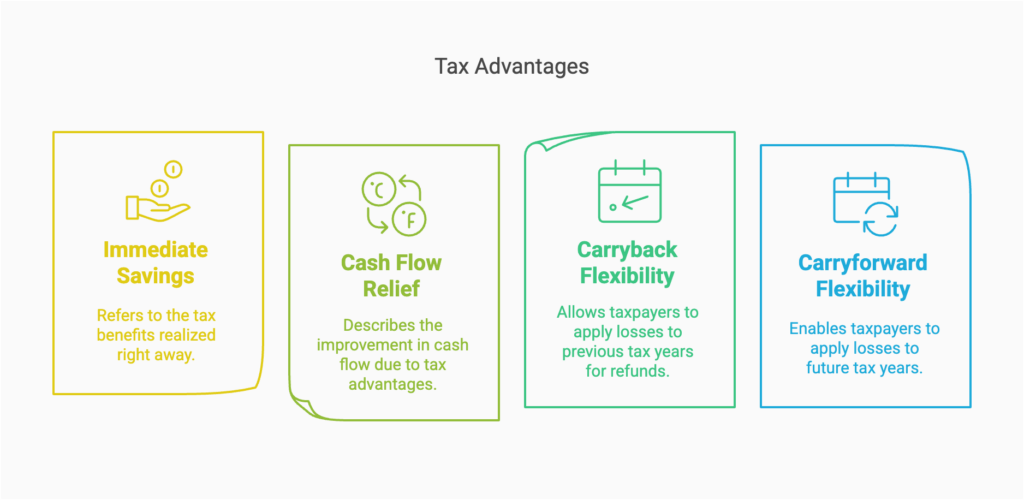

One of the most significant benefits of ABIL is the ability to offset losses against any type of income. This flexibility provides an immediate and substantial tax advantage:

Immediate Tax Savings

If you have a high taxable income, ABIL deductions can significantly reduce your tax burden. For instance:

- Suppose your taxable income is $100,000, and you claim an ABIL of $25,000.

- Your taxable income is reduced to $75,000, and at a marginal tax rate of 40%, you save $10,000 in taxes.

Cash Flow Relief

By lowering your taxable income across various sources, ABIL offers much-needed financial relief during difficult times, especially when a failed investment has strained your finances.

Carryback and Carryforward Flexibility

If you cannot use the deduction in the current year, ABIL can be applied retroactively to offset taxable income from the past three years or carried forward for up to ten years.

Eligibility Criteria for ABIL

To claim ABIL, your investment must meet specific conditions:

The Corporation Must Be a SBC:

- The company must have been a Canadian-controlled private corporation (CCPC) at the time of investment.

- At least 90% of its assets must have been used in active business operations in Canada.

The Investment Must Be for Income Generation:

- Shares or loans must be acquired with a reasonable expectation of earning income, such as dividends or interest. Note that eligible and non-eligible dividends have different personal tax implications.

- Investments made for personal reasons, emotional attachment, or hobbies do not qualify.

The Loss Must Be Realized:

- You must have sold or disposed of the investment, or the corporation must have been deemed bankrupt, insolvent, or closed.

Not sure whether incorporation is right for you? Learn more about its pros and cons.

The Income Generation Requirement: A Key Consideration

The requirement that an investment be made for income generation is a cornerstone of ABIL eligibility. The Canada Revenue Agency (CRA) scrutinizes this aspect to ensure that the deduction is claimed for legitimate business investments.

What Does “Income Generation” Mean?

To meet this requirement, the investment must have been made with a reasonable expectation of earning income, such as:

- Dividends from shares.

- Interest from loans or debt issued to the business.

- Capital appreciation from selling shares or debt at a profit.

Investments made for personal satisfaction, emotional reasons, or in hobby businesses are ineligible.

Examples of Qualifying vs. Non-Qualifying Investments

| Qualifying Investments | Non-Qualifying Investments |

| Purchasing shares in a CCPC with the expectation of dividends or capital appreciation. | Buying shares in a business solely because of personal connection or interest. |

| Issuing a formal loan to an SBC with terms for interest and repayment. | Lending money informally to a friend or relative without clear income intent. |

| Investing in a startup with a solid business plan and clear financial goals. | Supporting a family member’s hobby business with no expectation of financial returns. |

Proving Income Intent

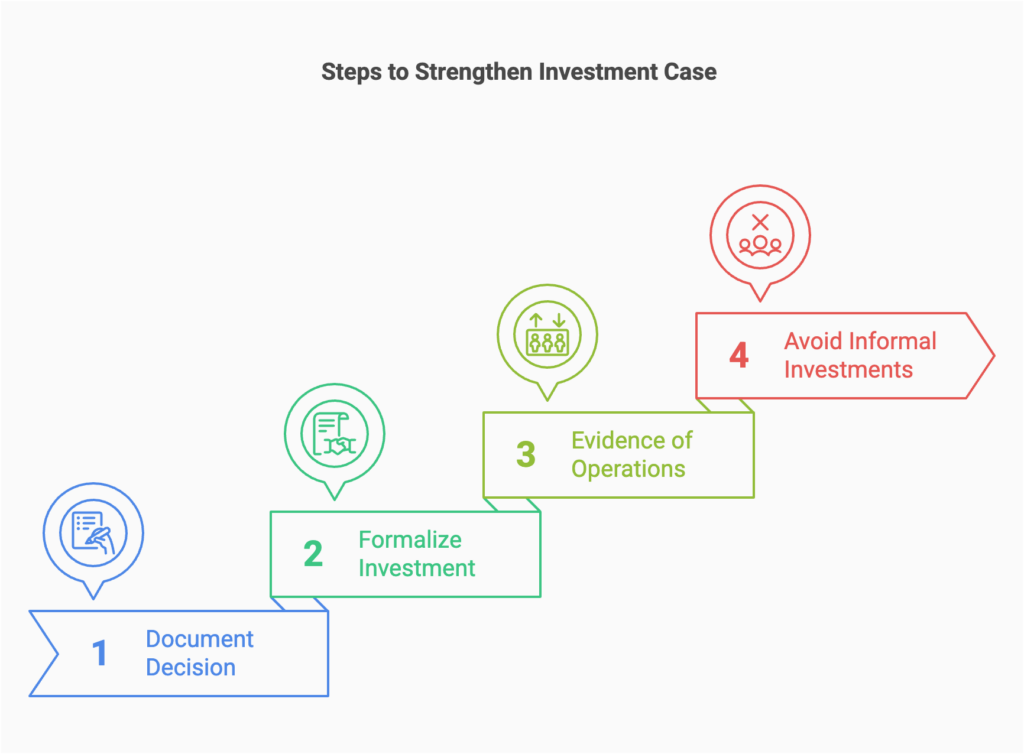

The burden of proof lies with the claimant to demonstrate that the investment was made with income generation in mind. To strengthen your case:

- Document Your Investment Decision:

- Retain business plans, financial projections, and other records showing the rationale for your investment.

- Formalize the Investment:

- Ensure the investment is structured professionally, with agreements for shares or loans.

- Show Evidence of Active Operations:

- Provide documents such as revenue statements or client contracts proving the business was active.

- Avoid Informal Investments:

- Hobby or personal investments are not eligible; ensure the business has a legitimate profit-making intent.

Filing and Documentation Requirements

Documents Needed for ABIL Claims:

- Proof of Investment:

- Share certificates, purchase agreements, or loan contracts.

- Proof of SBC Status:

- Financial statements showing 90% of the corporation’s assets were used in active business.

- Confirmation of CCPC status.

- Proof of Realized Loss:

- Bankruptcy notices, insolvency declarations, or trustee statements.

- Calculation of the Loss:

- Records of the original investment amount and any recoveries.

Filing Instructions:

- Claim the ABIL on line 21700 of your T1 Income Tax and Benefit Return.

- Report the loss on Schedule 3 (Capital Gains or Losses), calculating 50% of the total loss.

- Use the “Carryback of Losses” section on Schedule 3 or file a T1-ADJ Adjustment Request Form for retroactive claims.

Need help managing your payroll? Check out our review of the best payroll apps for QuickBooks Online.

CRA Challenges and How to Address Them

The CRA may closely examine ABIL claims, especially if:

- The investment does not clearly meet the SBC criteria.

- Income intent is unclear or unproven.

- Documentation is missing or inadequate.

How to Address Challenges:

- Maintain detailed records of the investment, the business’s SBC status, and the realized loss.

- Ensure all agreements are formalized and align with CRA guidelines.

- Consult a tax professional if you’re unsure about your eligibility or documentation.

Conclusion

The Allowable Business Investment Loss (ABIL) is a valuable tax tool that helps investors and entrepreneurs offset losses from failed small business investments. With the flexibility to deduct losses against any income and carry them back or forward, ABIL is essential for managing financial risks.

Understanding eligibility, maintaining proper documentation, and consulting a tax professional can maximize your claim. Don’t leave money on the table—start your ABIL claim and contact us today!