Exploring payroll platforms is crucial for businesses seeking efficient operations. In this blog, let’s take a personalized tour of three standout solutions—QuickBooks Online (QBO) Payroll, Wagepoint 2.0, and Payworks. Get ready to unravel their features and discover the unique benefits that can transform your payroll management experience.

Who’s this for?

- Small and medium-sized enterprises

- Entrepreneurs

Keep reading if you are:

- Interested in learning more about payroll platforms

- Seeking clarity on effective payroll management

Why does it matter to me? Choosing the right payroll platform is vital for business owners, affecting efficiency, compliance, and financial transparency. The selected platform directly influences payment accuracy, tax filing, and overall operational effectiveness.

TLDR

This article delves into three prominent payroll platforms: QBO Payroll, Wagepoint 2.0, and Payworks.

- Wagepoint, a Canadian company, undergoes rapid evolution with impressive new features and excels in friendly and efficient customer service.

- QBO Payroll offers out-of-the-box payroll capabilities, streamlined integration with minimal setup, and benefits from a large community for support

- Payworks, a well-established Canadian payroll processor, provides a comprehensive suite of HR services and excels in extensive payroll knowledge.

Unboxing and Review: 3 Full Service Payroll Apps for QBO

Brief Background Information of Platforms

- QuickBooks Online (QBO) Payroll: a cloud-based solution from Intuit, is designed to help SMEs efficiently manage payroll processes. Quickbooks itself was Introduced by Intuit in 1983, QuickBooks Online followed, offering users flexible access to financial data.

- Wagepoint 2.0: Wagepoint was founded in 2012, it is a Canadian company specializing in cloud-based payroll software for SMEs. With enhanced features, increased user control, and scalability, Wagepoint 2.0 provides an easier way for businesses to manage their workforce and payroll.

- Payworks: Founded in 2001, it is a Canadian company offering cloud-based payroll and workforce management solutions designed for both SMEs and larger organizations.

Delve Into the Features They All Have:

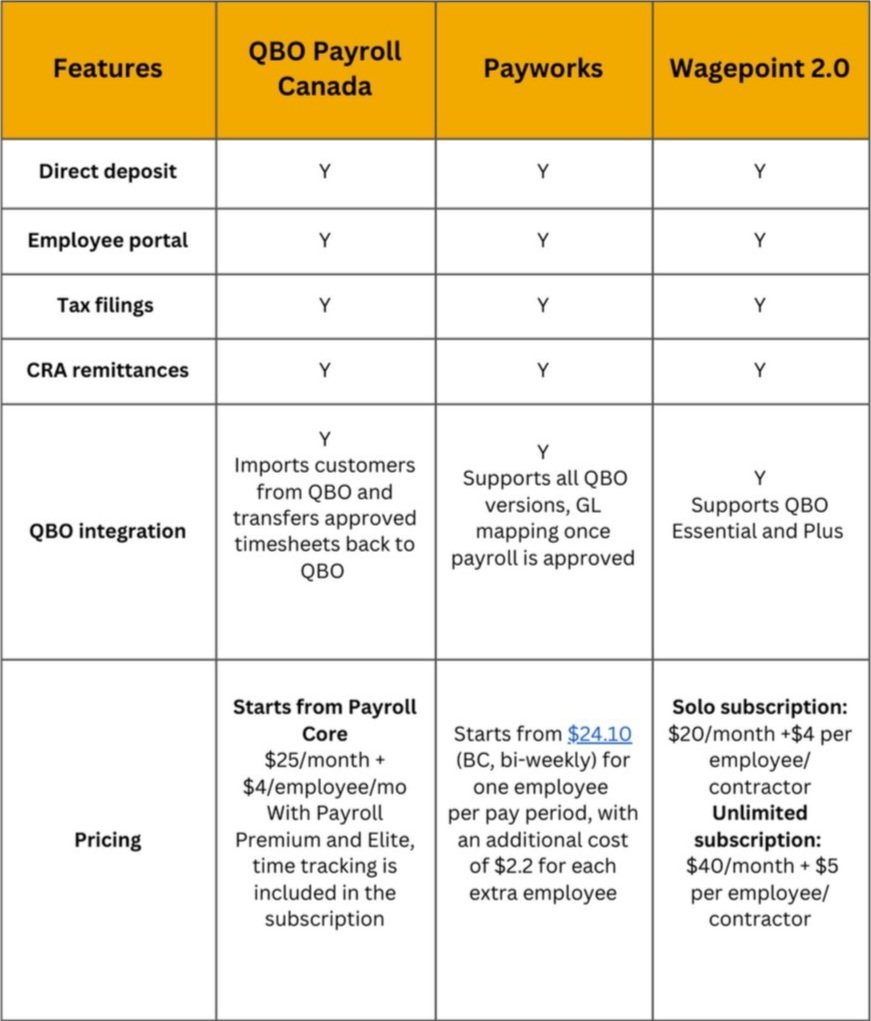

Each of these platforms, QuickBooks Online (QBO) Payroll, Wagepoint 2.0, and Payworks, shares fundamental functionalities crucial for effective payroll management.

- Direct Deposit: all three platforms efficiently streamline electronic fund transfers, simplifying and optimizing the payroll process.

- Employee Portal: Enhancing transparency, all three platforms offer centralized employee portals for seamless payroll information management.

- Tax Filings and CRA Remittances: All three platforms aid businesses in meeting tax obligations, ensuring accuracy in tax filings and CRA remittances.

- Varied QBO Integration Levels: QBO Payroll excels with seamless integration, Wagepoint 2.0 caters to specific QuickBooks versions, and Payworks supports integration with all QBO versions.

In conclusion, the decision among Wagepoint, QBO Payroll, and Payworks boils down to the specific needs of small business owners. Wagepoint, a Canadian company, undergoes rapid evolution, introducing impressive features and excelling in customer service—a valuable solution, particularly for those prioritizing swift support in payroll operations. QBO Payroll offers out-of-the-box payroll capabilities, streamlined integration with minimal setup, and benefits from a large community for support. Payworks, an established Canadian payroll processor, provides a comprehensive suite of HR services and excels in extensive payroll knowledge. Each platform brings its unique strengths, enabling business owners to make an informed choice based on factors such as innovation, integration, and comprehensive services. If you have any further questions regarding these platforms, please feel free to contact us.