Running a small business comes with many responsibilities, and bookkeeping is one of the most critical—especially when tax season rolls around. Effective bookkeeping makes tax preparation smoother, more accurate, and less stressful. If you’re a small business owner in Canada, here’s how you can streamline your bookkeeping process to make tax time easier, while ensuring you stay compliant with Canadian tax laws.

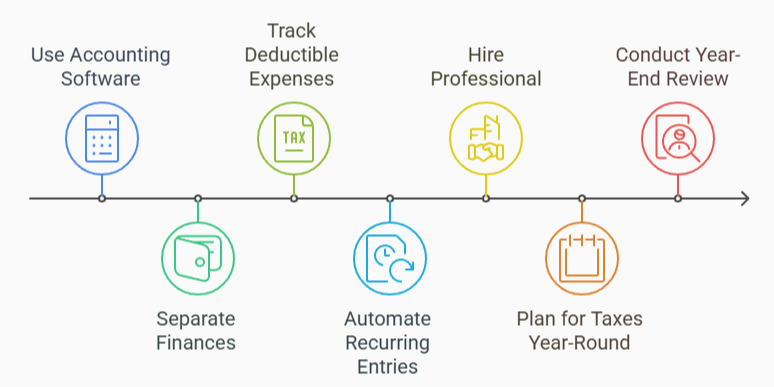

Use Accounting Software and Stay Organized with Documentation

Investing in reliable accounting software can save you a lot of time and effort. Tools like QuickBooks, Xero, or Dext (formerly Receipt Bank) help automate many aspects of bookkeeping, including categorizing expenses, tracking revenue, and generating reports. This allows you to stay organized and ensures your financial data is always ready for tax time.

Having organized receipts and documents is essential for claiming tax deductions and avoiding issues with the Canada Revenue Agency (CRA). Use apps like Dext to scan and categorize your receipts immediately, so you won’t have to sift through piles of paper when filing taxes. Keep both digital and physical copies of your receipts for at least 7 years to meet CRA’s record-keeping requirements.

Separate Personal and Business Finances

Keeping your personal and business finances separate is a must. Open a dedicated business bank account and use a business credit card for business transactions. Mixing your personal and business expenses can complicate tracking your finances and calculating taxes unnecessarily.

Regularly Reconcile Accounts, Review Financials, and Track Income & Expenses

Set aside time monthly to reconcile your business bank and credit card statements with your accounting software. This ensures your financial records are accurate and up to date, catching errors or discrepancies early to avoid headaches at tax time. At the end of each month, review and close your books to maintain a clear picture of your financial position and prevent small errors from growing.

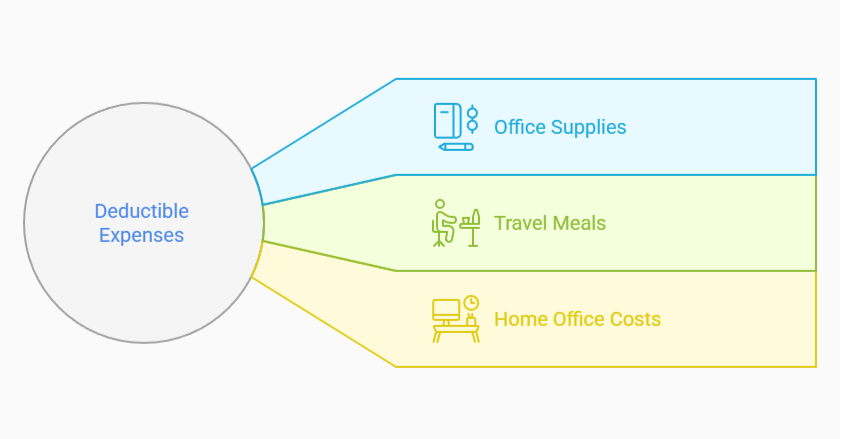

Keep detailed records of all income streams—whether sales, investments, or services rendered—and track deductible expenses such as office supplies, travel, meals, and home office costs throughout the year. Use accounting software to tag these items for easy access when filing taxes.

Automate Recurring Entries and Set Payment & Tax Reminders

Many business transactions like payroll, utilities, and rent are recurring. Automating these entries saves time and helps ensure proper categorization. Payroll software such as Wagepoint can streamline salary, tax, and deduction processes.

Additionally, setting reminders for tax deadlines and recurring payments helps you avoid penalties or missed payments.

Hire a Professional Bookkeeper or CPA and Stay Informed About Tax Laws

If bookkeeping isn’t your strength, consider hiring a professional bookkeeper to keep your books up to date and a CPA to guide you through tax deductions, saving opportunities, and filing processes. Working with a professional ensures compliance with CRA rules and regulations.

Stay informed about Canadian tax law changes—including GST/HST rates, tax credits, and business-specific deductions—by regularly checking the CRA website or consulting your CPA.

Plan for Taxes Year-Round and Conduct a Year-End Review

Plan your taxes throughout the year by setting aside about 20-30% of your revenue and making quarterly estimated payments to the CRA to avoid a large tax bill at year-end.

As the fiscal year closes, conduct a thorough review of your financials with your accountant or tax professional to maximize deductions and ensure everything is in order before filing. This review also provides a clear picture of your business’s financial health.

Conclusion

By implementing these steps, you can improve your bookkeeping process, reduce stress during tax season, and ensure your business is financially organized throughout the year. Small changes can make a big difference when it comes to tax time, and a bit of preparation can save you money, time, and a lot of headaches.

Need help getting started with your bookkeeping or tax preparation? Contact us today to schedule a consultation with one of our experts. Let us take the stress out of your business finances!