Do you know that a shareholder loan in Canada can be a useful tax planning tool, helping with income splitting, interest deductions, and business reinvestment? To avoid tax consequences, it’s essential to charge reasonable interest, repay loans within a year, and keep proper documentation. Always consult a tax professional to stay compliant and maximize benefits. Let’s dive in to learn more!

What Is a Shareholder Loan?

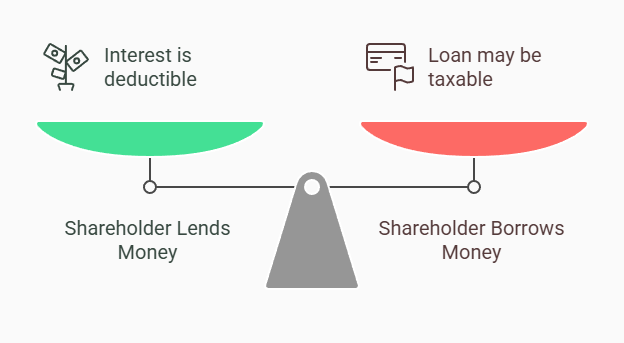

A shareholder loan in Canada refers to money borrowed by or from a shareholder of a corporation. It can take two main forms:

- Shareholder lends money to the corporation: This is when a shareholder provides funds to the corporation, often to help with cash flow or operations. The company may repay the loan with interest, and the interest paid can be deductible for the corporation.

- Shareholder borrows money from the corporation: This is when a corporation lends money to one of its shareholders. While this may seem convenient, it has strict tax rules under the Income Tax Act. If the loan isn’t repaid within a specific timeframe (usually by the end of the corporation’s next fiscal year), it may be considered taxable income to the shareholder.

Tax Benefits of Shareholder Loans

Tax planning with a shareholder loan in Canada can be an effective strategy for reducing personal and corporate taxes, but it must be approached carefully to ensure compliance with tax laws. Below are some common tax planning opportunities that can arise from shareholder loans:

1. Interest Deduction

- Interest on Loan: If a shareholder loan is made to the corporation, the shareholder may charge interest on the loan. This interest is deductible by the corporation, which can reduce its taxable income.

- Reasonable Interest Rates: The interest rate charged should be reasonable (typically close to the CRA’s prescribed rate). If the rate is too high or too low, it could trigger tax consequences.

- Personal Tax Considerations: For the shareholder, interest income from the loan is taxable as personal income. However, if the interest rate is set at or near the prescribed rate, the shareholder may be able to manage the overall tax impact, especially if the company is using the funds for business activities that generate income.

2. Capitalizing the Loan

- If the corporation is not able to repay the loan immediately, it can capitalize the loan, which means the loan balance becomes a part of the shareholder’s equity in the corporation. This can be beneficial if the shareholder eventually wants to take a portion of the business value out of the company as a dividend or sale proceeds rather than a loan repayment, which could offer more favorable tax treatment in certain situations.

- Family Loans: Shareholder loans can be a way for business owners to provide loans to family members who are shareholders. For example, a parent could lend funds to a child or spouse who is a shareholder of the corporation. If the shareholder repays the loan, the interest payments can be structured in a way that helps to reduce the overall family tax burden by shifting income to family members in lower tax brackets.

- Dividends vs. Loan Repayment: Instead of taking a dividend from the company (which is taxed as income), the shareholder could take a loan, which could be repaid over time. However, if the loan is not repaid within the required period, it could be treated as income by the CRA, which may defeat the purpose.

4. Loan Repayment and the One-Year Rule

- Shareholder loans that are not repaid within one year after the end of the corporation’s fiscal year may be treated as income by the CRA. To avoid this, proper tax planning must ensure that loans are repaid within the specified time frame. If the loan is repaid on time, it is not treated as income, and no tax liability arises.

- One strategy is to structure the loan repayment carefully within the one-year period, or to convert the loan into equity or capital if repayment isn’t feasible.

5. Loan Forgiveness and Dividends

- Forgiveness of Loans: Shareholder loans can be forgiven by the corporation. However, if the loan is forgiven, it may be considered income to the shareholder, which could trigger significant tax consequences. In some cases, it might be more tax-efficient to consider forgiving the loan in exchange for dividends or capital returns, which could be treated differently for tax purposes.

- Dividend Substitution: If you wish to withdraw funds from the corporation but want to avoid the immediate tax consequences of a dividend, you can take out a loan instead. Later, the loan can be treated as a dividend if certain conditions are met, allowing for tax-efficient distributions in some circumstances.

6. Reinvesting Loan Funds in the Corporation

- If the shareholder loans money to the corporation, it can allow the corporation to invest in capital expenditures, expansion, or research and development, which could result in future tax credits, deductions, and lower taxes on profits. This reinvestment strategy might improve the long-term tax position of the business.

7. Smoothing Out Taxable Income

- In some cases, a shareholder loan can be used to smooth out income by taking a loan in a year with lower income and paying it back in a higher-income year. This can reduce the overall tax burden in a higher-income year, as it could potentially be a non-taxable loan repayment in a year where other sources of income are higher and taxed at a higher rate.

8. Using Loans for Investment

- If the shareholder uses the loan to make investments (e.g., real estate or stocks), the interest expenses on the loan might be deductible, provided that the funds are used for income-generating purposes. This could be a way for the shareholder to reduce personal taxes while making use of the capital available to the corporation.

Key Considerations for Shareholder Loans

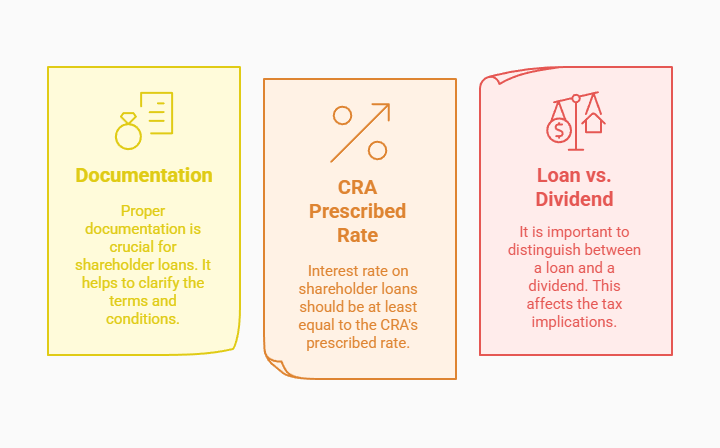

Documentation

- All loans should be properly documented with clear terms, interest rates, and repayment schedules to avoid complications with the CRA. This documentation ensures the loan is treated as legitimate and not as a dividend or income.

CRA Prescribed Rate

- Ensure that the interest rate on shareholder loans is at least equal to the CRA’s prescribed rate (currently updated quarterly). Failure to do so could result in imputed income and trigger tax consequences for both the shareholder and the corporation.

Loan vs. Dividend

- Before opting for a loan as a tax-planning tool, it’s important to consider whether it would be better to take a dividend, as dividends might be subject to lower tax rates for individuals, especially in the case of Canadian-controlled private corporations (CCPCs).

Conclusion

Tax laws surrounding shareholder loans can be complex, especially when it comes to ensuring compliance and minimizing tax liabilities. Contact us today to structure shareholder loans effectively while adhering to CRA regulations.