Do you really know how healthy your business is—beyond what’s in your bank account?

For business owners, understanding financial health goes far deeper than revenue alone. Two essential financial statements—the balance sheet and the cash flow statement—offer critical insights into your company’s stability, liquidity, and overall performance. But it’s not just about having these reports—it’s about knowing how to interpret the key metrics within them so you can make confident, informed decisions that drive long-term success.

Balance Sheet: The Financial Snapshot

The balance sheet provides a snapshot of your company’s financial position at a specific point in time. It details your assets, liabilities, and equity, helping you assess the overall value and financial health of your business.

Why it matters:

- Snapshot of Financial Health: The balance sheet shows the overall value of your business, providing an understanding of its net worth.

- Liquidity & Stability: It highlights your ability to meet both short-term and long-term financial obligations.

- Informed Decisions: It guides decisions on investing, cost-cutting, and raising capital.

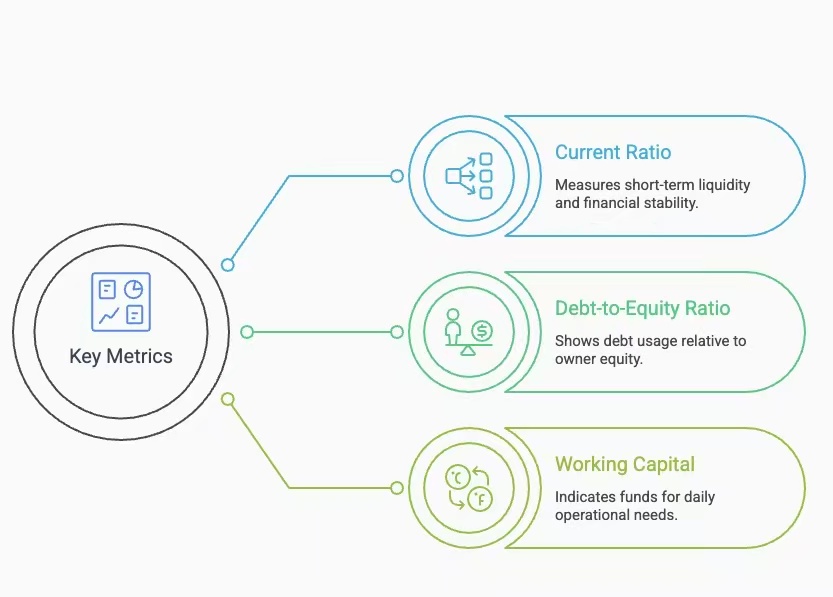

Key Metrics from the Balance Sheet:

- Current Ratio: This ratio measures short-term liquidity. A ratio above 1 indicates you have more assets than liabilities, suggesting financial stability.

- Debt-to-Equity Ratio: This metric reveals how much debt is used to finance your business compared to owner equity. A higher ratio increases financial risk, while a lower ratio indicates a more stable financial structure.

- Working Capital Current Assets: Working capital indicates the funds available for day-to-day operations. Positive working capital ensures you can meet your financial obligations without trouble.

Cash Flow Statement: The Cash Movement Tracker

The cash flow statement tracks the movement of cash in and out of your business over a specific period. This helps you understand how well your company manages cash to fund operations, pay debts, and invest in growth.

Why it matters:

- Cash Movement: Shows how cash is generated and spent, helping you ensure you have enough liquidity for business operations.

- Liquidity Monitoring: It highlights whether your business can meet its financial obligations without relying on external financing.

- Profitability vs. Cash: The cash flow statement shows if there’s a gap between your profits and available cash.

- Trend Analysis: It helps spot cash flow patterns, which is vital for budgeting and forecasting.

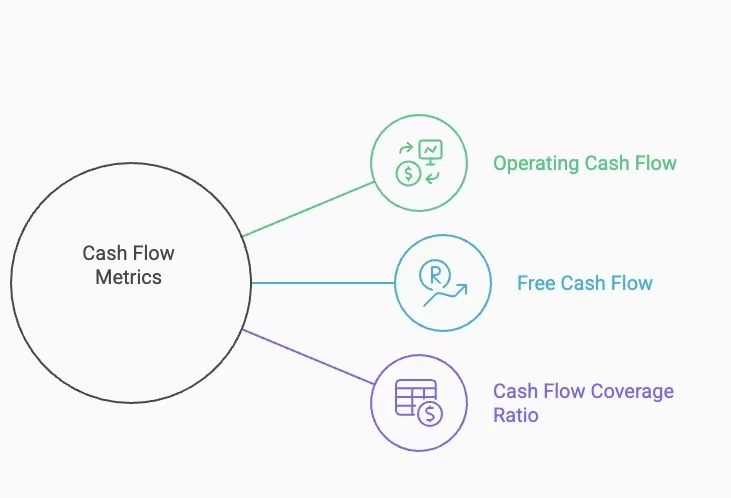

Key Metrics from the Cash Flow Statement:

- Operating Cash Flow: OCF reflects the cash generated from core business activities. Positive OCF indicates that the business is financially healthy and can sustain itself without external financing.

- Free Cash Flow: FCF shows the cash available after necessary investments. Healthy FCF is vital for paying down debt or reinvesting in growth opportunities.

- Cash Flow Coverage Ratio: This ratio shows if your business can cover its debt obligations with operating cash flow. A higher ratio reduces the risk of default.

How the Balance Sheet and Cash Flow Statement Work Together?

The balance sheet provides a static view of your company’s financial position, while the cash flow statement tracks dynamic cash movements over time. Together, they offer a comprehensive picture of your business’s financial health—helping you understand not just where you stand, but how you’re progressing.

Why These Metrics Matter for Business Owners?

Regularly analyzing these metrics helps you:

- Identify Financial Risks: Early detection of issues allows for proactive management and prevents larger problems down the line.

- Make Informed Decisions: These metrics guide decisions about budgeting, financing, and strategic investments.

- Build Credibility: A solid grasp of these financial indicators helps build trust with investors, lenders, and other stakeholders.

- Monitor Operational Efficiency: By evaluating your working capital, debt levels, and cash flows, you can improve your company’s efficiency and profitability.

Conclusion

Understanding your balance sheet and cash flow statement—and the key metrics within them—helps you assess liquidity, manage debt, identify risks, and make informed decisions that support long-term business growth.

If you’d like help interpreting your financial statements and turning the numbers into actionable insights, contact us today to gain clarity and confidence in your business decisions.