Staying on top of tax deadlines is essential for avoiding penalties and keeping your business on track. Whether you’re a sole proprietor, run a corporation, or collect GST/HST, your filing and payment dates can vary. This blog breaks down the key deadlines based on your business structure—so you never miss a payment or filing again.

Sole Proprietorships and Partnerships

For sole proprietors and partners, your business income is included as part of your personal tax return.

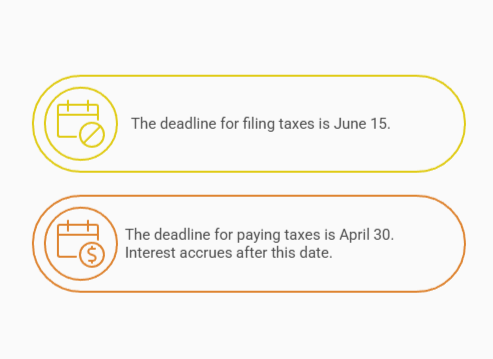

Tax Filing Deadline: June 15.

Payment Deadline: April 30 (even though the filing deadline is later, interest starts accruing after April 30 if taxes aren’t paid).

Corporations

Corporations operate on a separate fiscal year and have different filing and payment deadlines.

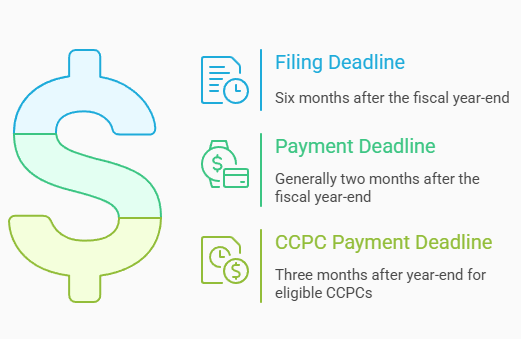

Corporate Tax Return Filing Deadline

- Six months after the end of your fiscal year.

- Example: If your fiscal year ends on December 31, your return is due by June 30.

Payment Deadline:

- Generally, two months after the fiscal year-end.

- For Canadian-controlled private corporations (CCPCs) eligible for the small business deduction, the deadline is three months after year-end.

GST/HST Filing and Payments

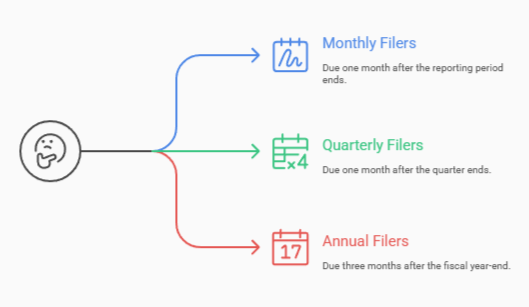

If your business is registered for GST/HST, the deadlines for filing and paying depend on your reporting period:

- Monthly Filers: Due one month after the reporting period ends.

- Quarterly Filers: Due one month after the quarter ends.

- Annual Filers: Due three months after your fiscal year-end.

Conclusion

Taxes can be complicated, but staying organized and aware of deadlines is half the battle. Set reminders, work with a qualified accountant, and keep accurate records throughout the year to make tax season stress-free. Reach out to us today to ensure your business stays compliant and optimized for success.