In our last blog, we explained what a standby charge is. In this blog, we will dive deeper into situations where a corporate vehicle is used more than 50% for personal purposes. In such cases, the standby charge can lead to a significant taxable benefit for the employee or business owner—potentially increasing their overall tax liability.

Standby Charge and Personal Use Over 50%

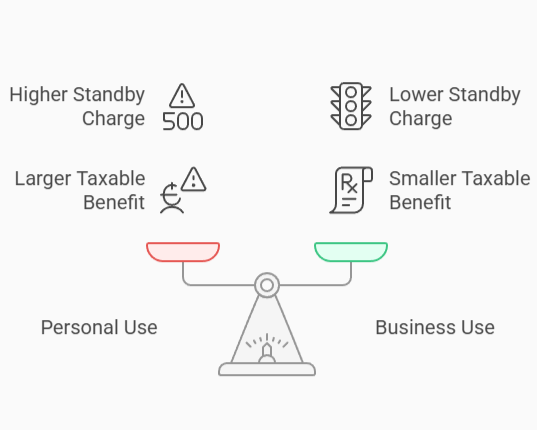

When the personal use of a company vehicle exceeds 50%, the standby charge is typically calculated based on the full cost (for a purchased vehicle) or lease payments (for a leased vehicle) without the benefit of a significant reduction for business use. In fact, the more the vehicle is used for personal purposes, the higher the standby charge could be, leading to a larger taxable benefit for the employee or business owner.

Impact on Standby Charge of More Than 50% Personal Use

Full Standby Charge

If the vehicle is used more than 50% for personal purposes, the business use reduction to the standby charge will be limited. In fact, some tax systems may not allow for any significant reduction to the standby charge if the personal use exceeds 50%. This means that the employee or business owner may end up with a larger taxable benefit because the standby charge is based on the full cost or lease payments, without a reduction for business use.

Example with Personal Use Over 50%

Let’s say a company car costs $40,000, and the standby charge is calculated as 2% of the original cost for each month the vehicle is available for personal use.

If the vehicle is used for more than 50% personal use and is available for 12 months, the full standby charge (without reduction) would be: 2% × 40,000 × 12 = $9,600 per year

The standby charge could end up being quite high, especially if the personal use is substantial, leading to a significant increase in the taxable income for the employee or business owner.

Taxable Benefit

The standby charge is added to the individual’s income and taxed at their personal income tax rate. Therefore, the more personal use the vehicle has, the higher the taxable benefit. Additionally, if the employee or business owner is using the vehicle for personal purposes, they may also be subject to the operating cost benefit for fuel, insurance, and other vehicle expenses, further increasing their taxable income.

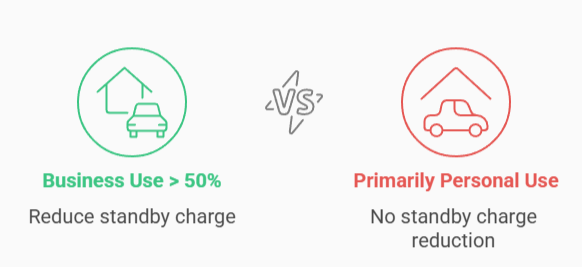

What Happens If the Vehicle is Used More Than 50% for Business?

Conversely, if the vehicle is used more than 50% for business, the standby charge is typically reduced based on the percentage of business use. However, if the vehicle is primarily used for personal purposes, the business cannot apply such reductions, which could make it financially worse off from a tax perspective.

Is the Standby Charge Worse Than Other Options?

In comparison to other tax strategies (e.g., paying for expenses directly, leasing, or using a mileage allowance), the standby charge could make it more expensive in terms of taxes if:

- The vehicle is used for a large amount of personal use.

- The company pays the full cost of the vehicle (or a significant lease cost), as the standby charge applies to these costs without a reduction for personal use.

- The individual receiving the vehicle as a benefit faces higher tax rates due to the added benefit being taxed as income.

How to Mitigate the Standby Charge?

To minimize the negative impact of the standby charge, the business can:

- Limit the personal use of the vehicle to reduce the taxable benefit.

- Track the percentage of business vs. personal use accurately to ensure the correct deduction for the business portion of the vehicle’s expenses.

- Consider alternative compensation structures like a mileage allowance or car allowance that would avoid the complications of the standby charge.

Conclusion

If a company vehicle is used over 50% for personal purposes, the standby charge becomes a larger taxable benefit—often leading to higher taxes. This may make alternatives like mileage allowances more tax-efficient. To minimize your tax liability, consider both the standby charge and your overall tax strategy. Contact us today to review your vehicle use and explore the most tax-effective approach for your business.