Choosing how to pay yourself—through salary, dividends, or a combination of both—is a key decision for Canadian business owners. Understanding the difference between salary and dividends can significantly affect your tax efficiency and ensure compliance with Canadian tax laws—ultimately strengthening your business’s financial health. This blog outlines the benefits and considerations of each approach to help you optimize your financial outcomes. Let’s dive in!

What Are the Considerations When Taking Salary or Dividends in My Corporation?

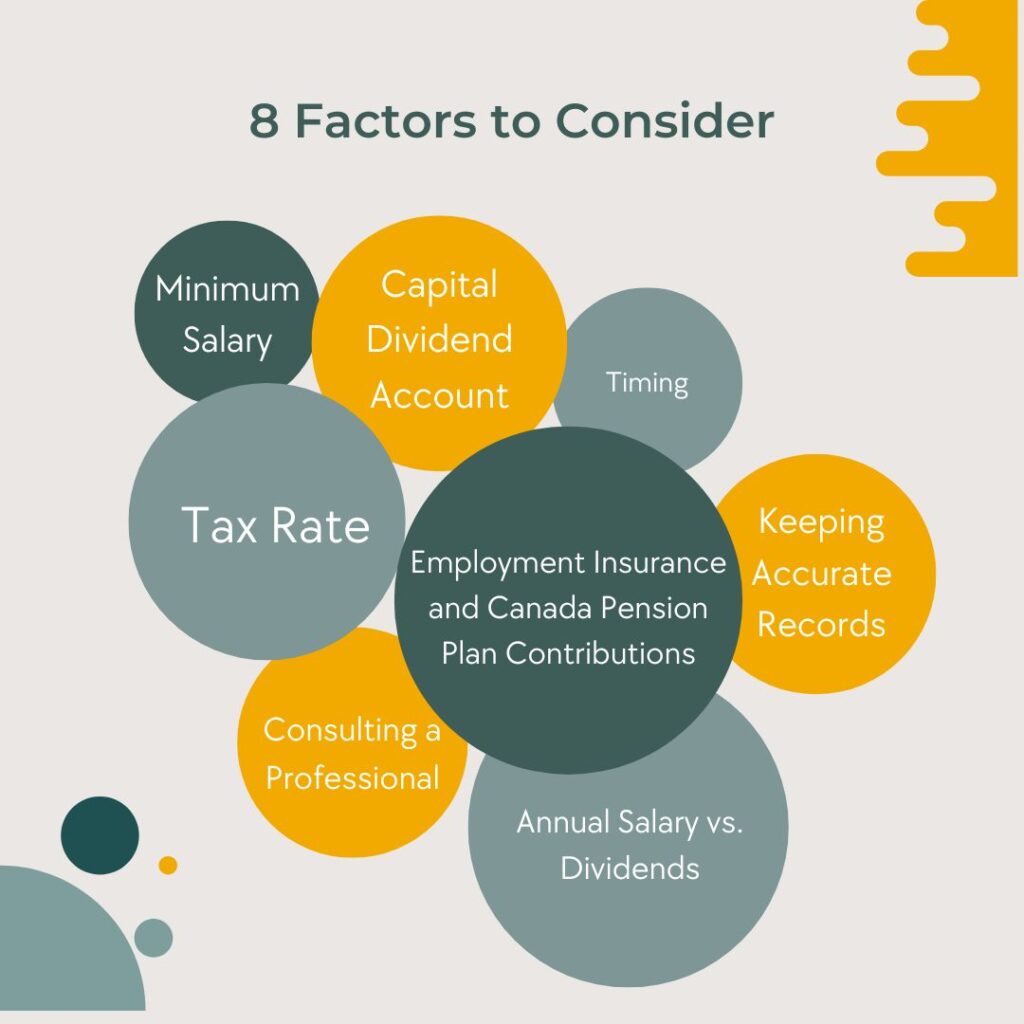

When taking salary or dividends from a corporation in Canada, there are several tax and legal considerations to keep in mind:

- Tax rates: Salaries are considered a business expense and are tax-deductible, while dividends are not. However, the personal tax rate on dividends is typically lower than the tax rate on salary.

- Employment Insurance (EI) and Canada Pension Plan (CPP) contributions: Salaries are subject to EI and CPP contributions, while dividends are not.

- Annual salary vs dividends: If a corporation is earning a profit, it’s often beneficial for shareholders to receive a mix of salary and dividends. This strategy balances lower personal tax rates on dividends with CPP and EI contributions from salary. Corporations should also assess whether to issue eligible or non-eligible dividends, as each carries different tax implications.

- Minimum salary: The Canada Revenue Agency (CRA) requires that a reasonable salary be paid to shareholders who are actively engaged in the business. This is to ensure that the shareholder is paying their fair share of taxes.

- Capital dividend account: Dividends paid out of the capital dividend account are tax-free for the shareholder.

- Timing: The timing of when salary and dividends are paid can affect the overall tax liability of the corporation and the shareholders.

- Keeping accurate records: Keeping accurate records of salary and dividends paid is important for tax compliance and also in case of an audit by the CRA.

- Consulting a professional: As the tax laws for salary and dividends can be complex and are subject to change, it is advisable to consult with a tax professional or accountant to ensure compliance and to plan for the most tax-efficient way to take money out of the corporation.

Making the right choice between salary and dividends requires careful consideration of your business’s financial status and your personal tax situation. At Purpose CPA, we specialize in providing tailored tax advice that aligns with your business goals. Don’t navigate these complex decisions alone—contact us today for expert guidance to ensure you maximize your earnings while remaining compliant with Canadian tax laws. Check out more about types of dividends in here.