In year-end accounting engagements, various letters are typically used to formalize the relationship between the accountant or auditor and the client, define responsibilities, and confirm the completion of work.

Engagement Letter

Purpose

The engagement letter outlines the terms and conditions of the professional services that will be provided by the accountant, auditor, or firm. It serves as the initial agreement that formalizes the relationship between the client and the service provider.

Content

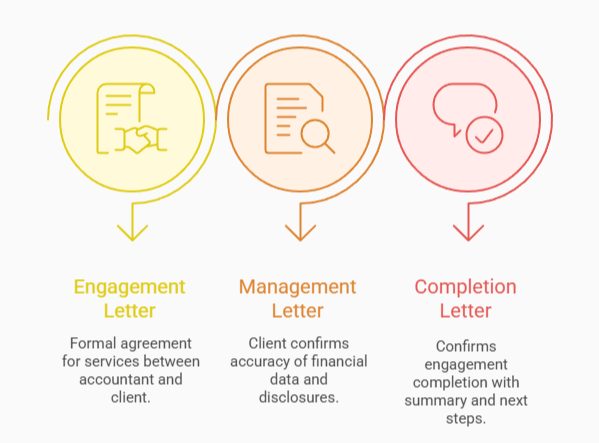

Scope of Services: Specifies what services will be provided, such as preparing financial statements, conducting audits, reviewing financial records, or performing other advisory services.

Responsibilities: Defines the responsibilities of both parties. For example, it might state that the client is responsible for providing accurate financial records, while the accountant is responsible for applying accounting principles to prepare financial statements.

Fees and Payment Terms: Details the fee structure (hourly, flat fee, or a combination), the payment schedule, and the conditions for additional charges.

Timeline: Includes timelines for the completion of the engagement.

Disclaimers and Limitations: Addresses any limitations of the service, including the scope of liability.

Termination Clause: Describes the conditions under which either party can terminate the agreement.

Management Representation Letter

Purpose

A management representation letter is typically used in audit and review engagements, and it is signed by the client’s management (usually senior management or executives). It represents management’s assertions regarding the accuracy, completeness, and reliability of the financial statements and the information provided to the auditor.

Content

Management’s Assertions: Management confirms that the financial statements are complete, accurate, and prepared in accordance with the applicable accounting standards.

Responsibility for Internal Controls: Management acknowledges its responsibility for maintaining effective internal controls over financial reporting.

Disclosure of Information: Management confirms that all relevant information has been disclosed to the auditor, including any known fraud, litigation, or other material matters.

Non-reliance on the Auditor: It typically states that the auditor will rely on the information provided by management and will not independently verify all of the assertions made by management.

Importance: This letter is crucial in an audit or review engagement as it helps protect the auditor from liability by ensuring that the auditor is relying on the representations made by the client.

Completion Letter

Purpose

A completion letter is issued by the accountant or auditor at the end of the engagement, confirming the completion of the work and summarizing the results or findings.

Content

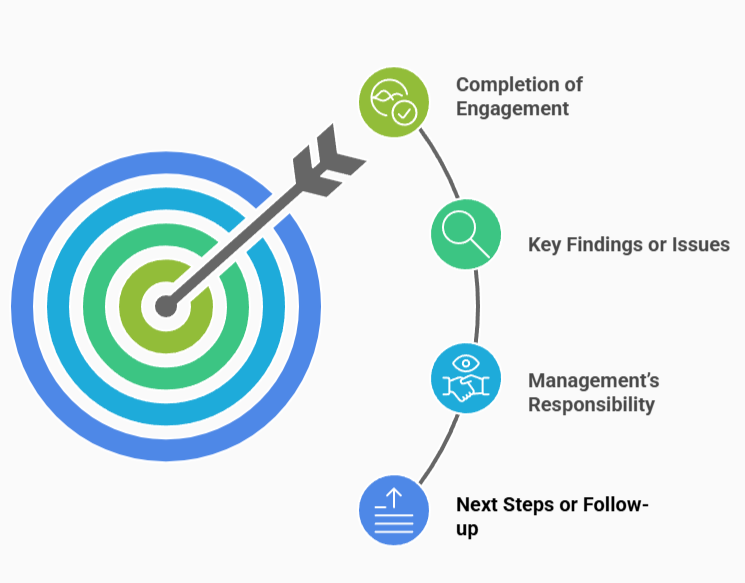

Completion of Engagement: It confirms that all agreed-upon services have been performed, including any required reports or financial statements.

Key Findings or Issues: If relevant, it may outline any issues discovered during the engagement, such as material misstatements, recommendations for improvement, or unresolved concerns.

Management’s Responsibility: Reaffirms that management is responsible for the financial statements and disclosures, even though the auditor or accountant has completed the engagement.

Next Steps or Follow-up: If necessary, the letter may include any actions that the client should take based on the engagement findings or any follow-up work required.

Conclusion

Engagement, representation, and completion letters are essential for a clear, compliant year-end accounting process. They outline responsibilities, confirm management’s financial disclosures, and summarize key outcomes. Contact us today to ensure your year-end runs smoothly and meets all requirements.