Thinking of hiring independent contractors? Before you do, make sure you understand your tax responsibilities—especially around T4A slips.

Whether you need to issue one depends on the nature of the work, your business structure, and whether the contractor is incorporated. This blog covers who must file a T4A, how to track and report payments, how to file in QuickBooks Online and what to do if a contractor doesn’t provide a SIN.

Who Needs to File a T4A Slip?

You must issue a T4A slip if:

- You paid an individual or sole proprietor (not a corporation) for services

- The total payments exceed $500 in a calendar year

- The payments fall under fees for services, commissions, or honorariums

- Payments to corporations (except management fees)

- Reimbursement of expenses (unless included in a service invoice)

- Payments under $500 (optional but recommended)

How to Track Contractor Payments?

Tracking payments correctly will save you time when preparing T4A slips.

Best Practices:

- Request a completed invoice from contractors

- Ensure invoices include the contractor’s full name, SIN/BN, and address

- Pay via bank transfer or check for easy tracking

- Categorize payments correctly in your accounting software

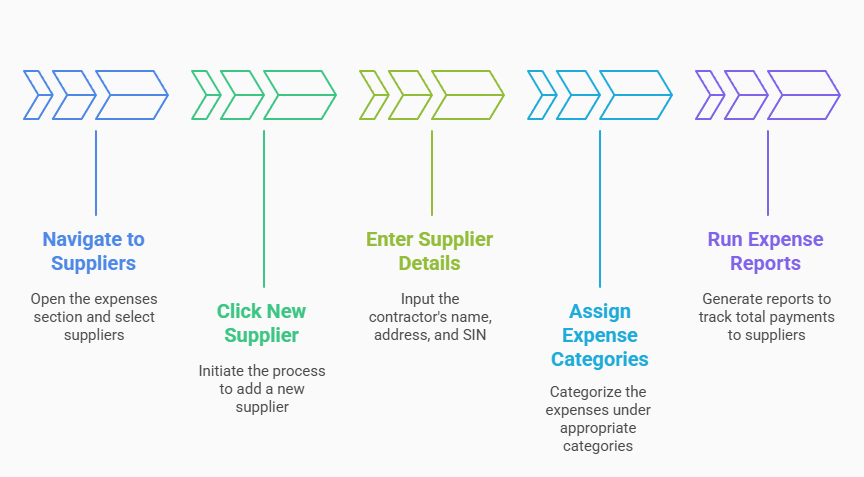

Tracking in QuickBooks Online (QBO):

- Go to Expenses > Suppliers

- Click New Supplier

- Enter the contractor’s name, address, SIN (if available)

- Assign expense categories (e.g., Professional Fees)

- Run Reports > Expenses by Supplier Summary to track total payments

Steps to File a T4A Slip in QuickBooks Online (QBO)

If you use QBO Payroll, you can generate and file T4A slips directly.

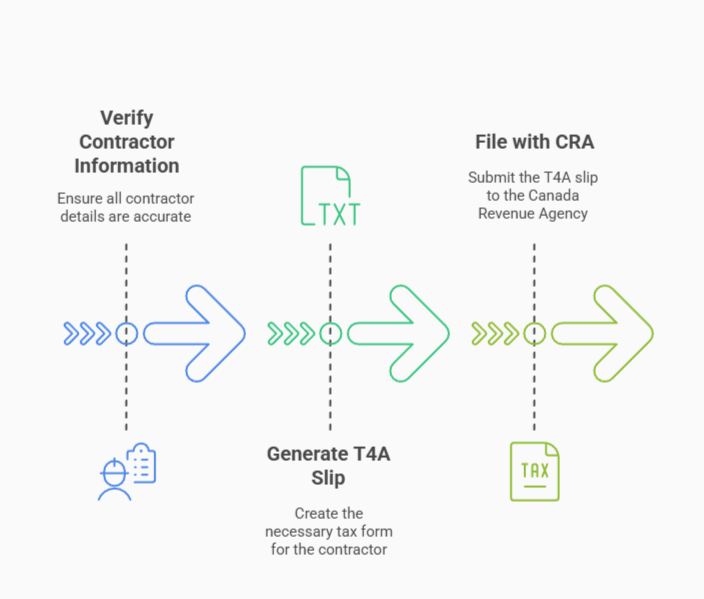

Step 1: Verify Contractor Information

- Go to Payroll > Contractors

- Select the contractor and confirm name, SIN, and address

Step 2: Generate T4A Slip

- Navigate to Payroll > Tax Forms

- Select T4A Slips

- Enter the total amount paid under Box 048 – Fees for Services

- Review and confirm details

Step 3: File with CRA

- E-file directly through QuickBooks or

- Download and manually submit via CRA’s My Business Account

Steps to Manually Prepare a T4A Slip

If you are not using QuickBooks Online, you can manually prepare and file a T4A slip using the CRA’s online tools.

Step 1: Gather Contractor Information

- Contractor’s full name or business name

- Social Insurance Number (SIN) or Business Number (BN)

- Contractor’s mailing address

- Total gross payments (including GST/HST if applicable)

Step 2: Download the CRA T4A Form

- T4A Fillable PDF from CRA

Step 3: Submit to CRA

- File electronically via CRA’s My Business Account

- Mail paper copies if filing fewer than 50 slips

File T4A Without SIN

Yes, you can still file a T4A even if the contractor has not provided their Social Insurance Number (SIN). However, you should:

- Make reasonable efforts to obtain the SIN (e.g., requesting it in writing)

- Keep records of your attempts to obtain it

- Report “000 000 000” in the SIN field if you still don’t have it by the filing deadline

The CRA requires businesses to make at least three attempts to obtain a contractor’s SIN. Failure to document these efforts may lead to penalties if an audit occurs.

How to Report Income on a T4A: Gross Income, GST, or Net Income?

When issuing a T4A slip, report the gross amount paid to the contractor, including any GST/HST paid. Do not deduct expenses from this amount.

Example:

- You pay a contractor $5,000 plus 5% GST ($250) = $5,250 total

- The T4A slip should report $5,250, not $5,000

Important Notes:

- If the contractor is registered for GST/HST, they must report GST/HST separately on their tax return.

- Contractors can claim business expenses separately on their tax return—do not deduct them when preparing the T4A.

Conclusion

Issuing T4A slips correctly ensures CRA compliance and avoids costly penalties. If you need help filing T4As, T4s, or managing contractor payments, don’t hesitate to reach out to us! Let’s ensure your tax processes are seamless and stress-free.