Proactive tax planning for small business in Canada can significantly reduce both corporate and personal taxes. Too often, business owners only think about taxes at year-end—when it’s already too late to make meaningful changes.

By planning ahead, Canadian business owners can align their corporate tax strategies with their personal income planning, lowering their total tax bill and improving cash flow year-round.

Why Proactive Tax Planning Matters in Canada?

In Canada, taxes are one of the largest expenses a small business will face. Proactive tax planning means taking steps before your year-end to legally minimize what you owe to the Canada Revenue Agency (CRA).

Benefits include:

- Lowering your overall tax burden by using available deductions, credits, and tax deferrals

- Avoiding surprises at tax time with accurate forecasting of income and taxes payable

- Improving cash flow by smoothing out tax obligations across the year

- Aligning tax strategies with your business and personal financial goals

When done early, tax planning lets you take full advantage of CRA-approved tax strategies for small business owners in Canada.

Reducing Corporate Taxes Through Proactive Planning

For incorporated businesses, corporate tax planning for Canadian business owners is essential to keep more profits inside your company. Key strategies include:

- Maximizing the Small Business Deduction (SBD): Keeping taxable income under the $500,000 federal limit to access lower small business corporate tax rates.

- Timing major expenses and bonuses: Accelerating purchases or bonuses in high-profit years to lower taxable income.

- Claiming available credits and incentives: Planning ahead to use Scientific Research & Experimental Development (SR&ED) credits, apprenticeship credits, and other CRA incentives.

- Managing retained earnings and passive income: Monitoring investment income inside the company to avoid losing access to the SBD.

- Tax deferral strategies: Leaving profits in the corporation to grow at lower corporate tax rates until needed.

These are proven methods on how to reduce corporate taxes in Canada and keep more cash available to reinvest in your business.

Coordinating Owner-Manager and Shareholder Taxes

Canadian owner-managers must also plan how they extract income from their corporation. Personal and corporate tax planning must work together to lower your combined taxes:

- Salary vs. dividend mix: Salaries are deductible to the corporation and create RRSP room, while dividends are taxed at lower personal rates. The right mix reduces total tax.

- Income splitting: Paying reasonable salaries to family members in lower tax brackets can reduce household taxes (within CRA’s reasonableness rules).

- Timing withdrawals: Declaring bonuses or dividends before or after December 31 can shift income between calendar years to lower personal tax brackets.

- Personal tax planning: Align RRSP contributions, charitable donations, and capital gains planning with business income levels.

Done right, this coordination creates a tax-efficient flow of funds from your corporation to you as a shareholder, while staying fully compliant with CRA requirements.

Salary vs Dividends: Tax Planning Comparison for Canadian Business Owners

| Factor | Salary (T4) | Dividends (T5) |

| Tax deductibility to corporation | ✅ Deductible — reduces corporate taxable income | ❌ Not deductible — paid from after-tax corporate profits |

| Personal tax rate | Higher personal marginal tax rates | Lower personal tax rates (grossed-up with credit) |

| CPP contributions | ✅ Required (employer + employee portions) | ❌ Not required |

| RRSP contribution room created | ✅ Yes — 18% of earned income up to CRA limit | ❌ No — does not count as earned income |

| Cash flow impact on corporation | ❌ Immediate cash outflow + payroll remittance | ✅ Can pay when cash is available |

| Corporate tax deferral | ❌ Less — income paid out right away | ✅ More — profits can remain in corp at lower rates |

| T4/T5 reporting | ✅ Requires payroll setup and remittances | ✅ Requires dividend slips at year-end |

| Best used when… | You want RRSP room, stable salary, and CPP credits | You want to withdraw profits flexibly and reduce payroll costs |

Key takeaway: Most Canadian owner-managers benefit from a blend of salary and dividends in Canada to reduce combined corporate and personal tax.

Example: Reducing Income to Qualify for the Small Business Deduction

Let’s say you’re a BC-based incorporated business owner expecting $600,000 in net income this year. The federal Small Business Deduction (SBD) limit is $500,000. Any active business income above $500,000 will be taxed at the general corporate tax rate (around 27% in British Columbia) instead of the lower small business rate (around 12% in BC).

Proactive year-end tax planning for incorporated businesses could include:

- Paying bonuses to owner-managers or staff

- A $100,000 bonus paid before year-end is deductible to the corporation and shifts the income to the individual (at personal rates).

- A $100,000 bonus paid before year-end is deductible to the corporation and shifts the income to the individual (at personal rates).

- Accelerating planned expenses

- Purchase equipment or technology upgrades this year to claim capital cost allowance (CCA) earlier.

- Prepay certain expenses (insurance, professional fees) if reasonable.

- Purchase equipment or technology upgrades this year to claim capital cost allowance (CCA) earlier.

- Making employer contributions to employee benefits or pension plans

- Such as profit-sharing bonuses or setting up an Individual Pension Plan (IPP).

- Such as profit-sharing bonuses or setting up an Individual Pension Plan (IPP).

- Hiring and training initiatives

- Investing in new hires or training to trigger eligible CRA credits.

- Investing in new hires or training to trigger eligible CRA credits.

Outcome:

If you successfully reduce net income from $600,000 to $500,000, the last $100,000 avoids the higher general tax rate, saving roughly $15,000 incorporate tax—plus any personal planning benefits from bonuses or purchases.

This is only possible if you plan before your fiscal year-end.

Why Timing Matters?

Effective tax planning isn’t something that can be done overnight. It takes time to assess your current financial position, develop a tailored strategy, and implement the necessary steps before your year-end. Waiting until tax season leaves no room to act—by then, the opportunity has passed. Starting early gives your accountant time to review your books, model different scenarios, and put the right structures in place so you can capture every available tax-saving opportunity.

The Risks of Reactive Tax Planning

Waiting until tax season to think about taxes often leads to missed opportunities and expensive mistakes. By the time you sit down to file, most strategies that could have reduced your taxes—like bonuses, capital purchases, or RRSP planning—are no longer available. Instead of controlling outcomes, you’re left reacting to a bill you can’t change. That can mean paying thousands more in corporate and personal taxes, facing surprise cash flow pressures, and losing the chance to reinvest that money back into your business. Reactive planning turns tax season into damage control—while proactive planning turns it into a competitive advantage.

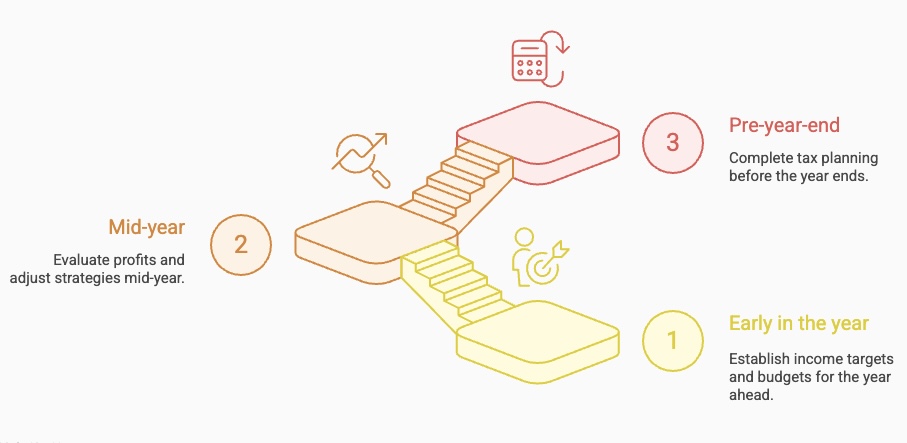

When to Do Tax Planning in Canada?

Tax planning should be a year-round process for Canadian business owners:

- Early in the year – set income targets and budgets

- Mid-year – review profits and adjust strategies

- Fall (pre-year-end) – finalize tax moves before December 31

This gives you enough time to act on strategies before they expire.

Conclusion

Proactive tax planning for small business in Canada is one of the most effective ways to minimize taxes for incorporated business owners. By planning early and reviewing regularly, you can keep more of your profits, build wealth inside your corporation, and avoid tax season stress.

If you’re unsure where to start, contacting us can give you the clarity and structure you need. A proactive planning session can help you assess your current position, map out strategies, and take action well before year-end—so you can approach tax season with confidence instead of pressure.