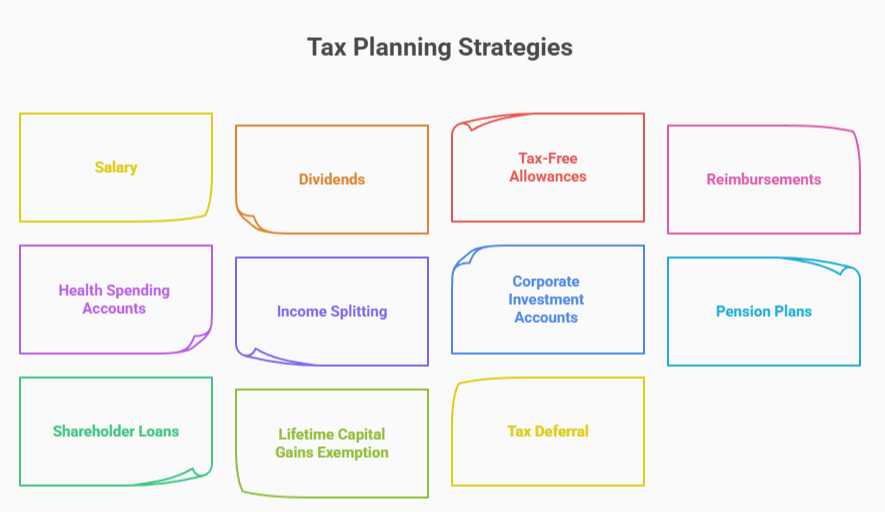

As a business owner in Canada, managing your personal and corporate taxes is crucial for maximizing your earnings and minimizing your tax liability. While you can’t pay yourself completely “tax-free,” there are several tax planning opportunities that can significantly reduce your tax burden. Here’s a breakdown of some of the most effective strategies for paying yourself from your Canadian corporation.

Salary vs. Dividends: What’s the Best Option?

When it comes to paying yourself, you have two primary options: salary or dividends.

- Salary: A salary is considered an expense for your corporation, which can reduce its taxable income. However, the salary is taxable to you personally, and you’ll need to pay income tax on it. On the plus side, paying yourself a salary allows you to contribute to the Canada Pension Plan (CPP) and accumulate RRSP contribution room.

- Dividends: Dividends are paid from after-tax profits and are taxed more favorably due to the dividend tax credit. Dividends are not subject to CPP contributions, which makes them a more tax-efficient way to pay yourself if you’re looking to minimize taxes. However, note that dividends are not tax-deductible for the corporation.

Tax-Free Allowances or Reimbursements

You can reduce your taxable income by reimbursing yourself for legitimate business expenses, such as home office costs, vehicle expenses, and business-related meals. These reimbursements are generally tax-free, provided they are reasonable and well-documented.

Health Spending Accounts (HSAs)

A Health Spending Account (HSA) is a great way to pay for medical expenses tax-free. Through an HSA, your corporation can cover medical costs for you and your family, while the contributions are deductible for the corporation. The best part? When you withdraw funds for eligible medical expenses, they’re not taxed as income.

Income Splitting with Family Members

If you have family members in lower tax brackets, you may want to consider income splitting by issuing dividends to them. However, be aware of the TOSI (Tax on Split Income) rules, which restrict this strategy unless certain criteria are met.

Corporate Investment Accounts

Instead of paying yourself out of the corporation immediately, consider leaving profits within the company and investing them. Corporate investments are taxed at a lower corporate tax rate, and you can defer personal tax until you withdraw the funds. This strategy can help you grow your wealth within the corporation at a more favorable tax rate.

Pension Plans: IPPs and DPSPs

Setting up an Individual Pension Plan (IPP) or a Deferred Profit Sharing Plan (DPSP) for yourself can help you contribute to your retirement on a tax-deferred basis. These employer-sponsored plans allow for larger contributions than an RRSP, potentially lowering your taxable income and increasing your retirement savings.

Shareholder Loans

Your corporation can extend a shareholder loan to you, which may not be taxed if it’s repaid within the required timeframe (usually within one year). However, strict rules apply to shareholder loans, and it’s essential to ensure that the loan is repaid on time to avoid tax implications.

Lifetime Capital Gains Exemption (LCGE)

If your corporation is a Canadian-controlled private corporation (CCPC), you may be eligible for the Lifetime Capital Gains Exemption (LCGE), which allows you to sell shares in your business tax-free up to a certain limit. This is an excellent way to realize profits from your business without triggering significant taxes.

Tax Deferral through Corporate Investments

By retaining profits within the corporation, you can defer personal taxes until you decide to withdraw funds. If the corporation is reinvesting those profits, the income generated is taxed at a lower corporate rate, which allows you to benefit from tax deferral.

Key Takeaways

While there’s no way to pay yourself entirely tax-free, these strategies can help minimize your tax burden and keep more money in your pocket. Whether you choose to pay yourself a salary, dividends, or leverage other tax-planning tools like Health Spending Accounts or pension plans, the right approach will depend on your personal and business goals.

Conclusion

Navigating the complexities of tax planning for your Canadian corporation can be tricky, but the right strategy can make a world of difference. Contact us today to speak with a tax professional and start optimizing your tax strategy to keep more of your hard-earned money.