Resources

Resources

Accounting, tax, payroll, and other useful resources curated for both businesses and individuals.

Financial Tools & Templates for Clarity and Growth

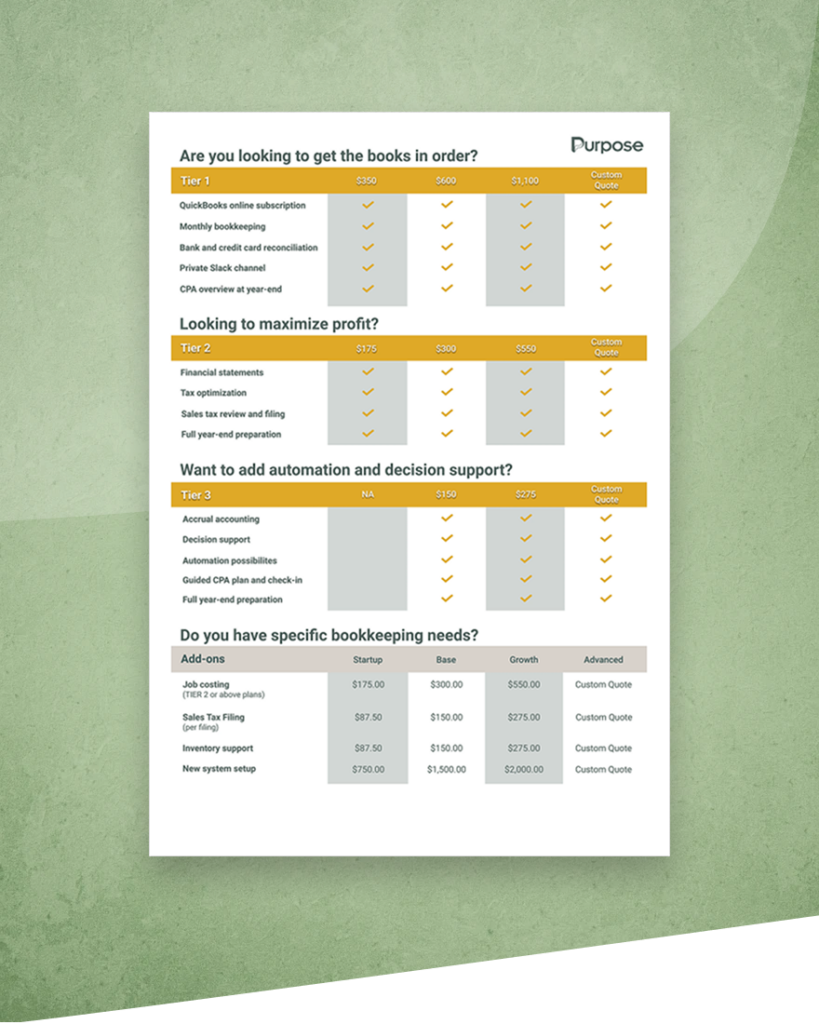

We’re a QuickBooks Online–first firm because we believe it’s the most reliable, scalable accounting platform for modern Canadian businesses. This Resources page was created with support from Intuit to help business owners make everyday financial management simpler.

See how prepared your business is for strategic advisory or fractional controllership support. Get a quick snapshot of your current readiness with our free 8-question quiz.

Assessment

See how healthy your bookkeeping system really is. Complete this quick 10-question quiz to assess the accuracy, timeliness, and compliance of your bookkeeping systems.

Assessment

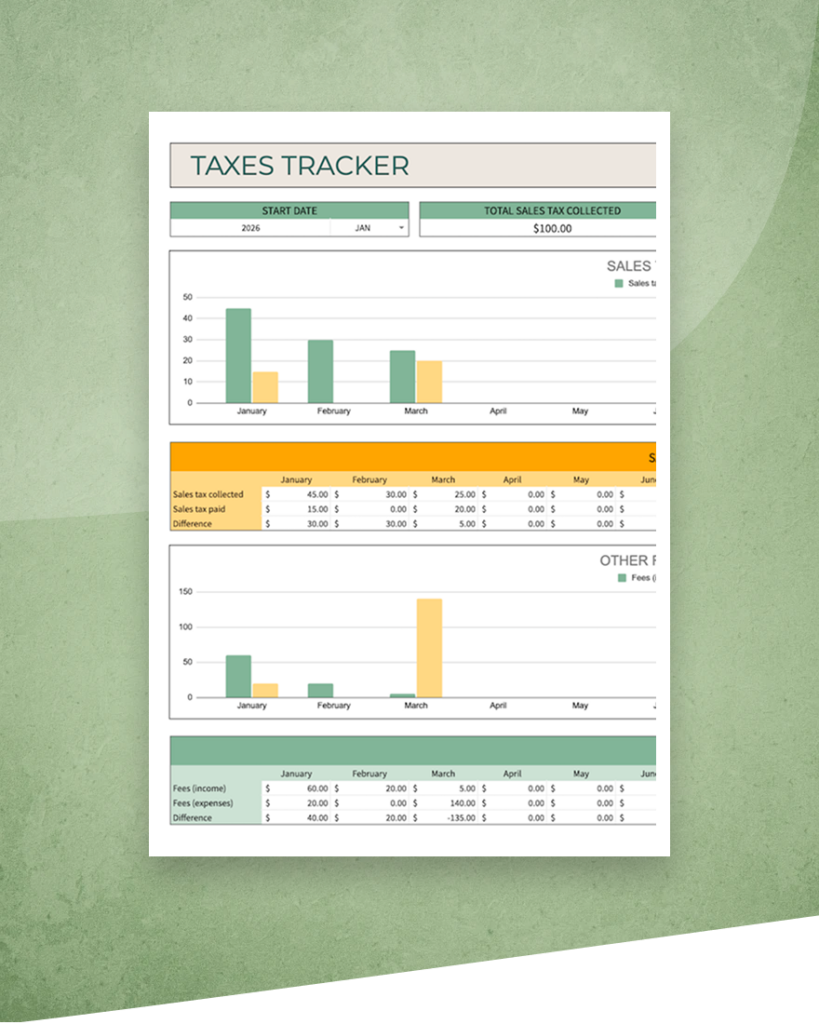

A simple bookkeeping template for small businesses to record income, expenses, and keep financial data organized year-round.

Template, Spreadsheet

Stay informed and empowered with our quarterly Tax Tips & Traps Report, highlighting key insights and timely issues relevant to Canadian small business owners.

Checklist, Spreadsheet

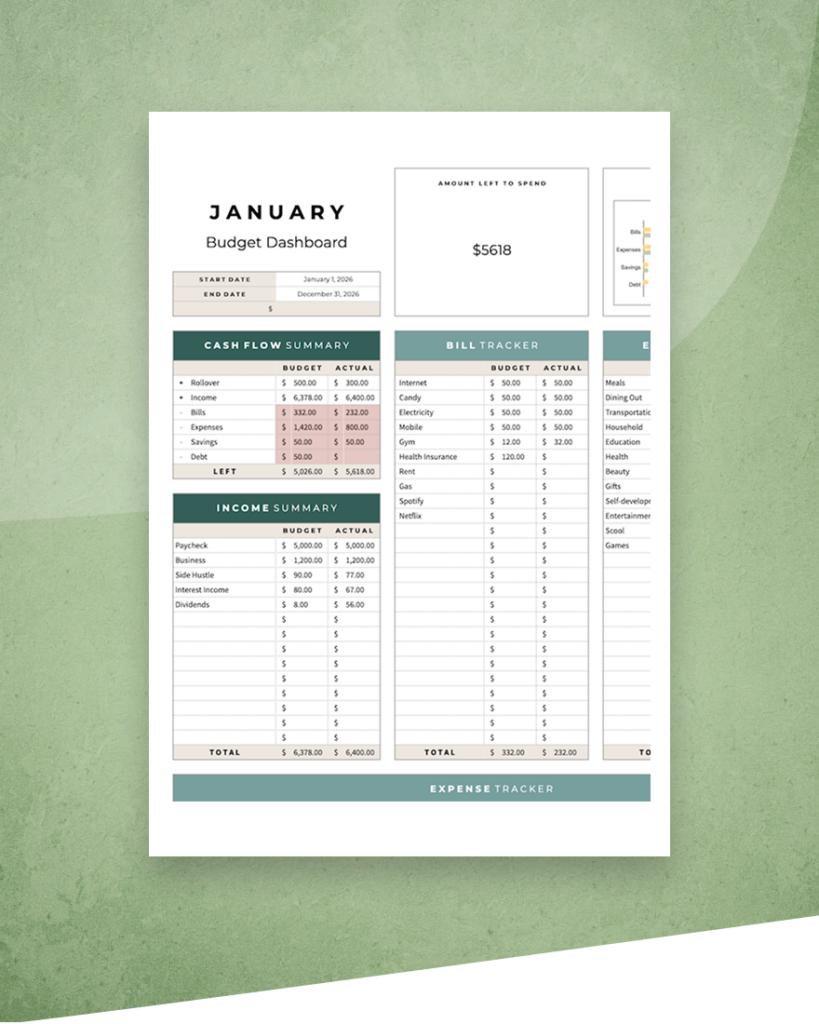

An easy-to-use budget spreadsheet that helps small businesses track income, control spending, and understand cash flow.

Template, Spreadsheet

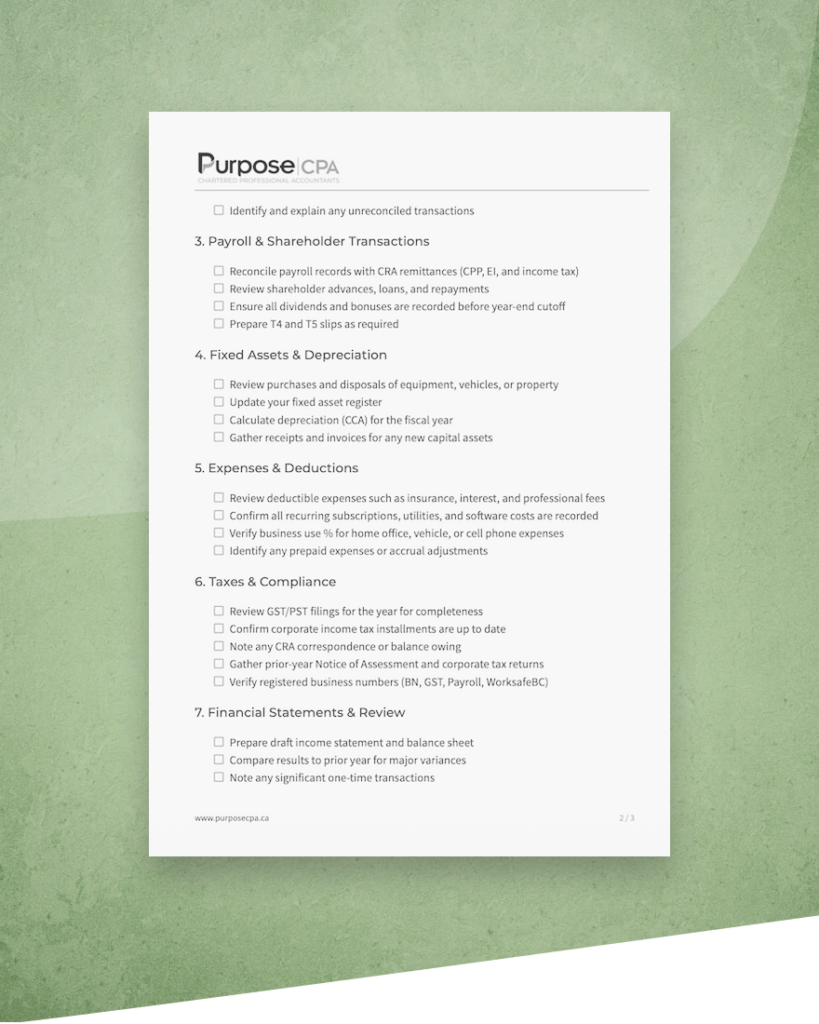

Essential year-end checklist for BC corporations. Ensure accurate filing, avoid penalties, and prep for your accountant.

Checklist, PDF

QuickBooks Online simplifies how you track your business finances, so you can focus on the bigger picture.