In our previous blog, we shared tips on how to choose the right bookkeeper for your business. But hiring the right person is only the first step—protecting your business from bookkeeper fraud is just as important.

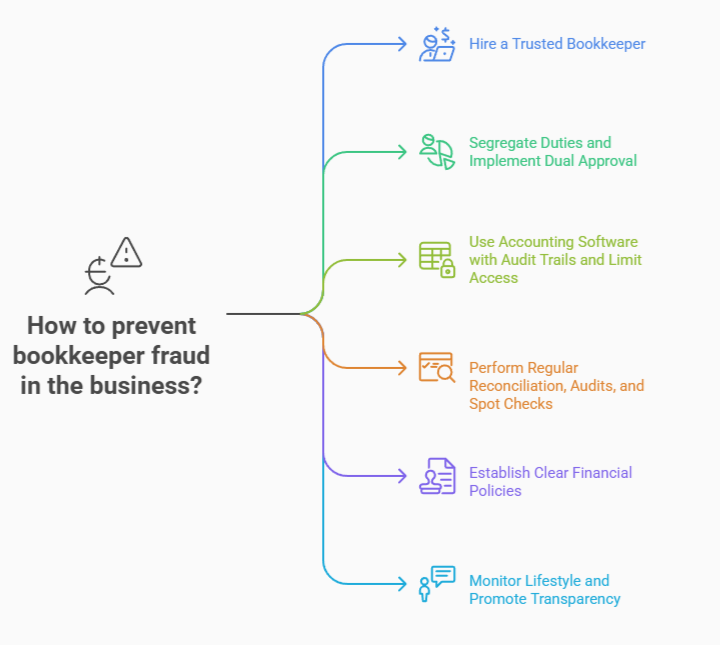

Unfortunately, bookkeeper fraud is a real threat that can cause significant financial and operational damage if left unchecked. However, the good news is that there are proactive measures you can take to safeguard your business, from hiring trusted professionals and segregating financial duties to using secure accounting software, performing regular audits, and fostering transparency. Read on to learn the key steps you can implement today to protect your company’s financial health.

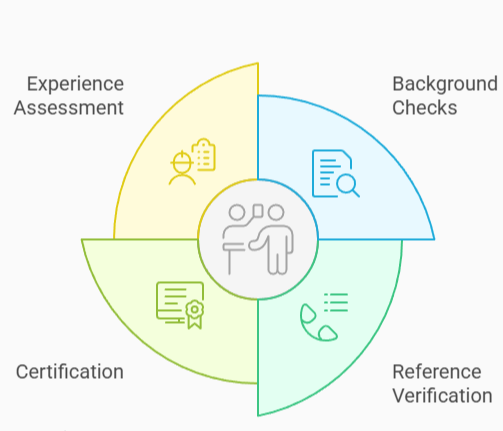

Hire a Trusted Bookkeeper

Start by hiring a professional you can trust. Conduct thorough background checks, ask for references, and consider hiring certified bookkeepers with relevant experience. A reputable bookkeeper will be more likely to follow ethical standards and adhere to best practices.

Segregate Financial Duties and Implement Dual Approval

If possible, avoid having a single person responsible for all financial tasks. For instance, one person should handle bill payments, while another person reconciles accounts. This creates a system of checks and balances that can help spot discrepancies before they become larger problems.

For larger payments or transfers, implement a system of dual approval so that no single person, not even your bookkeeper, has the sole authority to authorize significant transactions. This safeguard helps prevent fraudulent actions from going unnoticed.

Use Accounting Software with Audit Trails and Limit Access

Leverage accounting software that provides audit trails—like QuickBooks or Xero. These platforms log every action taken within the system, making it easy to track any suspicious activity. Set up alerts for large transactions or changes in financial records so you’re always in the loop.

Minimize access to sensitive financial information by allowing your bookkeeper to access only what is necessary for their role, and keep other financial accounts restricted to a select few to reduce the opportunity for misuse.

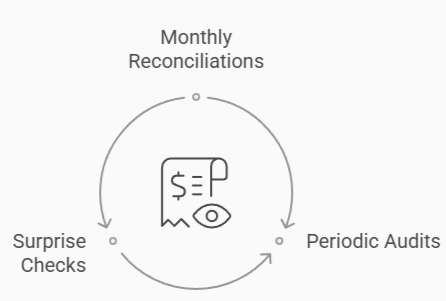

Perform Regular Reconciliation, Audits, and Spot Checks

It’s essential to regularly reconcile your business’s financial statements and conduct internal or external audits. Monthly reconciliations ensure discrepancies are caught early, while periodic audits by a professional accountant can provide a more thorough review. Surprise checks are also a good way to stay vigilant—occasionally review financial records without prior notice to ensure everything is in order. Spotting errors early can prevent fraud from escalating.

Establish Clear Financial Policies

Clear financial policies are a must. Define spending limits, approval processes, and the necessary documentation for every transaction. Ensure that all employees, including your bookkeeper, understand and follow these policies to avoid confusion and potential fraud.

Monitor Lifestyle and Promote Transparency

It may sound odd, but monitoring your bookkeeper’s lifestyle can offer clues about potential fraud. If you notice unusual changes in their spending habits or lifestyle, it might indicate financial misconduct—so be observant and address any concerns immediately.

At the same time, create a culture of transparency within your business. Encourage open communication about financial matters so any concerns or discrepancies are brought to your attention right away. Transparency builds trust and reduces the likelihood of dishonest behavior.

Conclusion

Preventing bookkeeper fraud is about creating a strong system of checks and balances, using the right tools, and staying vigilant. By taking these proactive steps, you can protect your business’s financial integrity and ensure that your hard-earned profits are safeguarded.