Canada Digital Adoption Program

Access up to $15,000 in government funding through the Boost Your Business Technology grant, and $100,000 in interest-free loans.

What is the CDAP Grant?

The Canada Digital Adoption Program (CDAP) is a government initiative to help small to medium-sized enterprises (SMEs) adopt new digital technologies. The Canadian government has committed $4 billion to the program over the next four years.

If you’re a registered business in Canada with at least one full-time equivalent employee, you’re likely eligible for one or both grants.

How much is the CDAP Grant?

The CDAP grant is composed of two streams, a microgrant and the larger Boost Your Business Technology grant with stricter eligibility criteria.

Stream 1

$2,400 microgrant towards digital implementation by a government-trained student or new grad advisor.

Stream 2

Up to $15,000 to cover 90% of the costs of hiring an approved advisor to develop a digital plan.

$100,000 in interest-free loans for implementation of the plan.

$7,300 in wage subsidies to hire Canadian youth to implement the plan.

Where can I find a CDAP Digital Advisor

For Stream 2, SMEs must work with an approved digital advisor registered with CDAP. These are organizations that meet and maintains all of the required criteria to deliver digital advisory services. Approved advisors are required to provide vendor neutral advice and are subject to CDAP’s Code of Conduct. They will work with eligible SMEs to digital adoption plans which are required to meet the minimum viable elements identified in the CDAP digital adoption plan guide.

Purpose CPA is a registered CDAP Digital Advisor.

A listing of all CDAP digital advisors is available in the program’s marketplace after approval of the CDAP grant.

Which stream is right for my business?

The official program site has a Grant Assessment Tool with these questions to determine which is right for you:

Do you have between 1 and 499 employees?

Which sector is your business in?

Where is your head office located?

What are you looking to do?

Did you have annual revenues between $500,000 and $100,000,000 in any of the past three tax years?

Stream 1 is intended for customer-facing businesses who haven’t yet adopted digital tech to implement their e-commerce strategies, with funding to support up to 90,000 businesses.

Stream 2 is designed to help up to 70,000 SMEs adopt new digital technologies and strategies, so the grant is much larger. It’s best suited for enterprises with high operational costs and the business is in need of capital and outside, independent expertise to move technology forward.

What costs are eligible? How can the CDAP grant benefit my company?

Stream 1 benefits most businesses.

Businesses are paired with a youth digital advisor and funds can be spent on a variety of technologies including: cloud accounting, accounts receivable, accounts payable, payroll, costing, inventory management, and HR.

Stream 2 is to be used to retain a digital advisor to provide advisory service. This can include:

Providing support during the grant application process to maximize funding.

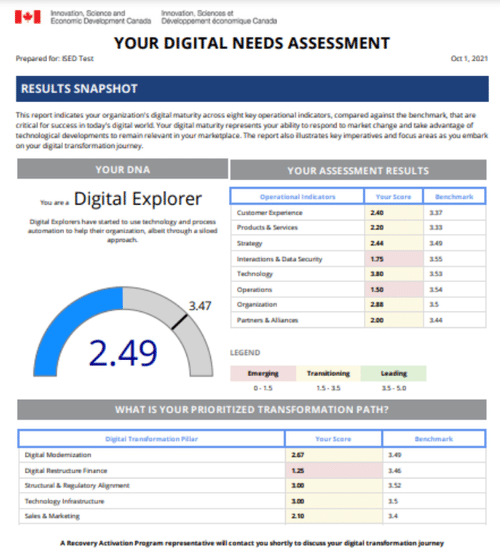

Completing a digital needs assessment to review your operations, current technology and business strategy to identify where you can benefit most and what to prioritize.

Research and recommend technology solutions to fit your business and budget, including a cost / benefit analysis of the top options. Some areas Purpose CPA has expertise in are (but not limited to):

Accounting system assessment, selection, design, implementation and training. Examples: Quickbooks Online, Xero, Sage50, Quickbooks Desktop

CRM, ERP, HRIS integration

Business strategy, operations and change management assessment, design, and execution

E-commerce strategy, system selection, design, and integration

Paperless company transformation

Developing a comprehensive digital strategy and implementation roadmap with steps, timelines, and resources to achieve your business objectives.

How do I apply?

Applications are through the official Canada Digital Adoption Program website:

Click here to apply on ic.gc.ca

Purpose CPA can work with you to select the right CDAP stream(s) and assist you in preparing and submitting the applications. We’ve been approved by the federal government in advising Canadian SMEs under the CDAP program.

FAQ - CDAP

Can I work with any company that offers digital services?

Only government-approved digital advisors can provide services for Stream 2.

I’m not sure how to answer my Digital Maturity Assessment, can Purpose CPA help?

We’d be happy to guide you through the assessment process. Book a call at the bottom of this FAQ!

Is my business eligible for the CDAP grant?

Use the CDAP Program’s Grant Assessment Tool. Unlike other recent tech grants, you must have at least 1 full-time equivalent employee.

Can Purpose CPA help us apply for the CDAP grant?

Business owners or directors must apply for the grant, however we can walk you through the process.

Is Purpose CPA an approved digital advisor for the CDAP program?

Yes, Purpose CPA is a registered and approved advisor. Learn more about the requirements to be a CDAP digital advisor on the program site.