Many people enjoy hobbies like photography, crafting, or baking—some even start earning income from them. But at what point does a hobby become a business? If you’re making money from a personal activity, it’s important to understand your tax obligations in Canada.

The CRA distinguishes hobbies from businesses based on intent and how the activity is carried out. A hobby is for personal enjoyment; a business is run with the expectation of profit. If your hobby earns significant income or operates commercially, the CRA may classify it as a business—requiring you to report income, track expenses, and possibly register for GST/HST.

Let’s dive in to explore more details and how to stay compliant.

The Difference Between a Business and a Hobby

The CRA defines a hobby as an activity undertaken for pleasure, entertainment, or enjoyment rather than with a profit motive. However, if you operate your hobby in a commercial and businesslike manner, it may be considered a business and taxed accordingly.

Key Differences:

| Factor | Hobby | Business |

| Intent | Done for enjoyment | Operated to make a profit |

| Income | Not taxable in most cases | Must be reported on tax returns |

| Expenses | Not deductible | Deductible against business income |

| GST/HST | Not applicable | Must be charged if earning over $30,000/year |

If a hobby consistently generates profit, the CRA will likely classify it as a business. However, if you report ongoing losses, the CRA may deny your deductions unless you can prove a reasonable expectation of profit.

How to Determine if Your Hobby is a Business?

To assess whether your activity is a business, the CRA applies the profit test, considering factors such as:

- Past profit and loss experience

- The amount of income reported over multiple years

- Time commitment and effort involved

- Your experience, training, or education in the field

- Whether you actively market and promote your products/services

- Whether you have a business plan

- If the business can reasonably be expected to make a profit in the future

If your hobby is taking up substantial time and resources, the CRA may consider it a business—especially if you are actively scaling, advertising, and reinvesting profits.

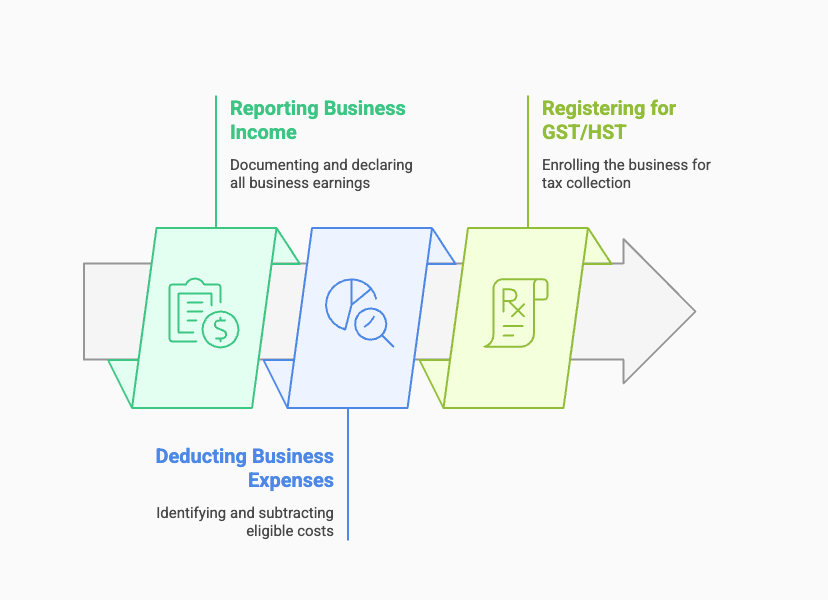

How to Report Business Income, Claim Expenses, and Stay GST/HST Compliant in Canada?

1. Reporting Business Income

Once your hobby transitions into a business, you are legally required to report income. This includes revenue from online sales, craft fairs, social media, or word-of-mouth referrals.

How to Report Business Income:

- Use the T2125 Statement of Business or Professional Activities when filing your personal tax return.

- If your business is registered (sole proprietorship, partnership, or corporation), you may have additional tax filing requirements.

- Income should be reported when earned, not just when payment is received.

2. Deducting Business Expenses

One major tax benefit of running a business is the ability to deduct business-related expenses.

Common deductible business expenses include:

- Supplies & Materials – Costs for goods or services used in your business.

- Advertising & Marketing – Social media ads, business cards, and website costs.

- Office & Home Office Expenses – If you work from home, a portion of rent/utilities may be deductible.

- Professional Fees – Accounting, bookkeeping, and legal services.

- Business-Use Vehicle Expenses – Gas, insurance, and maintenance (pro-rated for business use).

- GST/HST Paid on Expenses – If registered, you can claim Input Tax Credits (ITCs) to recover GST/HST paid on eligible purchases.

3. Registering for and Remitting GST/HST

If your business earns $30,000+ in gross revenue over four consecutive quarters, you must register for a GST/HST number and start charging tax on taxable goods/services.

Steps for GST/HST Compliance:

- Register for a GST/HST Number – Online via the CRA or by phone.

- Charge GST/HST on Sales – The tax rate depends on your province (e.g., 5% in Alberta, 13% in Ontario, 15% in Nova Scotia).

- Track GST/HST Collected and Paid – Use accounting software to track sales tax and claim Input Tax Credits (ITCs).

- File GST/HST Returns on Time – The frequency depends on your revenue (monthly, quarterly, or annually).

- Remit GST/HST to the CRA – Ensure timely payments to avoid penalties.

Conclusion

Knowing whether your activity is a hobby or a business is key to staying compliant with Canadian tax laws. If your hobby generates income, you may need to report it, track expenses, and register for GST/HST.

Clear records and professional advice can help you avoid surprises. Contact us today to ensure you’re on the right track and making the most of available deductions.