A holding company in Canada offers benefits like asset protection, tax deferral, and estate planning for small business owners. It can help with income splitting, preserving the Capital Gains Exemption, and investing surplus funds.

However, it adds complexity and costs, and the Tax on Split Income (TOSI) rules may limit some benefits. Professional advice is essential to structure it correctly.

What is a Holding Company?

A holding company is a type of business entity that owns shares in other companies but does not produce goods or services itself. Its main purpose is to control or manage other businesses, known as subsidiaries.

Key Features:

- Ownership, not operation: A holding company holds majority or full ownership of other companies but usually doesn’t get involved in day-to-day operations.

- Asset protection: It can be used to separate valuable assets (like real estate or intellectual property) from business risks.

- Tax planning: Holding companies can help with income splitting, deferring taxes, or accessing certain tax advantages (especially in Canada).

- Dividends flow through: Subsidiaries can pay tax-free intercorporate dividends to the holding company, which may then reinvest or distribute them.

Key Advantages for a Holding Company

As a small business owner in Canada, you may be looking for ways to protect your assets, reduce taxes, and simplify your business structure. One effective strategy is setting up a holding company. This can offer several key advantages, allowing you to streamline operations, safeguard assets, and plan for the future.

- Asset Protection

One of the primary benefits of a holding company is asset protection. A holding company can own the shares, intellectual property, or other assets of your operating company. By keeping these assets separate, you create a layer of protection in case the operating company faces legal or financial difficulties. If the operating business gets into trouble, creditors may only have access to the operating company’s assets, not the valuable holdings in the holding company. - Tax Deferral

In Canada, dividends paid from your operating company to a holding company are generally tax-free, thanks to the inter-corporate dividend rules. This means that the operating company can distribute profits to the holding company without triggering immediate tax obligations. You can defer taxes on these profits until they are distributed to you personally from the holding company, offering significant flexibility in managing your tax burden. - Estate Planning

A holding company can also play an essential role in your estate planning. By holding ownership of your business through a holding company, you can plan for the transfer of shares to your heirs in a tax-efficient manner. Strategies like estate freezes allow you to lock in the value of the business, while future growth is passed on to your beneficiaries. This can minimize estate taxes and ensure a smoother transition of ownership across generations. - Income Splitting

If family members are shareholders in the holding company, you may be able to distribute dividends among them, potentially reducing your family’s overall tax liability. However, it’s important to note that the Tax on Split Income (TOSI) rules limit income splitting opportunities, particularly for family members who are not actively involved in the business. With proper planning, a holding company can still be an effective tool for income splitting and reducing taxes. - Capital Gains Exemption

When selling shares of a small business, you may be eligible for the Lifetime Capital Gains Exemption (LCGE), which can exempt a portion of the capital gains from tax. A holding company structure can help you maximize this exemption, as long as the business meets the necessary criteria. By holding the shares through a holding company, you can better organize your business for the eventual sale and take advantage of tax-saving opportunities. - Investment Opportunities

A holding company allows you to reinvest surplus profits into other ventures, such as stocks, real estate, or other businesses. This keeps excess funds out of your operating company, where they may be exposed to risks. The holding company can act as a centralized investment hub for your personal and business assets, offering opportunities for further growth and diversification. - Simplified Ownership of Multiple Businesses

If you own several businesses, a holding company can centralize the ownership and management of all your ventures. Instead of managing individual entities separately, you can consolidate assets and shares under a single holding company, making the overall structure simpler to maintain. This can also help streamline tax reporting and estate planning. - Creditor Proofing

By moving valuable assets and surplus cash into the holding company, you can reduce exposure to creditors if your operating company faces financial trouble. The holding company can hold these assets in a safer, more secure structure, minimizing the risk of them being seized by creditors.

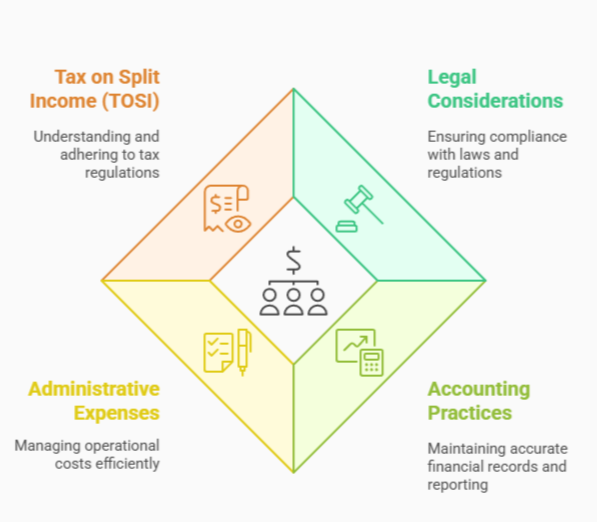

Key Considerations for the Holding Company

While a holding company offers many benefits, it also introduces additional complexity and costs.

Setting up and maintaining a holding company involves legal, accounting, and administrative expenses. It’s important to work with tax advisors, accountants, and lawyers to ensure the structure aligns with your business goals and complies with Canadian tax laws. Additionally, the Tax on Split Income (TOSI) rules may limit the ability to split income with family members, so careful planning is necessary to avoid unintended tax consequences.

Conclusion

A holding company can help Canadian small business owners protect assets, defer taxes, and plan for the future. With the right setup, it offers strong financial and succession benefits. Contact us today to explore how it could support your business’s growth and security!