The 2025 Federal Budget encourages Canadian businesses to invest in both productivity and innovation. Two measures stand out — the immediate expensing for manufacturing and processing equipment and the return of SR&ED eligibility on capital expenditures. Together, they reward companies that modernize, expand, or innovate — and the impact becomes even greater when equipment is financed.

Immediate expensing for manufacturing and processing

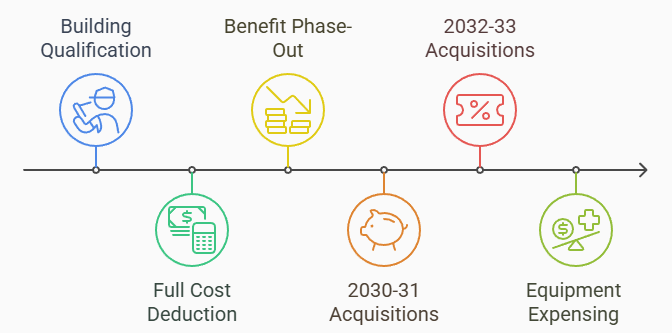

Businesses that acquire new manufacturing or processing buildings and equipment after November 4, 2025 can now claim a 100 percent first-year write-off.

Key highlights

- The full cost of qualifying manufacturing or processing buildings can be deducted in the year they are placed in use.

- Buildings must be used primarily (at least 90%) for manufacturing or processing before 2030.

- The benefit phases out after 2030 — 75% for 2030–31 acquisitions and 55% for 2032–33.

- Immediate expensing also applies to new machinery, production lines, and technology that enhance productivity.

Why it matters

Immediate expensing lowers the after-tax cost of major projects and improves payback periods. Businesses planning plant upgrades, automation, or capacity expansion can reinvest the tax savings into growth much sooner.

SR&ED eligibility restored for capital expenditures

The Budget reinstates SR&ED tax credits for capital assets used directly in scientific research and experimental development.

In practice

- Equipment, machinery, or facilities used in R&D can again qualify for SR&ED credits.

- This reverses a long-standing exclusion that prevented most capital costs from being claimed.

- Businesses developing new products or processes can now recover a portion of their investment through both capital deductions and SR&ED credits.

Why it matters

Re-allowing SR&ED on capital encourages innovation investment. The same equipment that supports production improvements can now generate additional tax credits when used for experimental development — improving overall project returns.

Working with Elevyn Consulting

At Purpose CPA, we work closely with Matt Funk at Elevyn Consulting, who specializes in SR&ED claims and technical documentation.

Elevyn Consulting provides in-depth guidance on SR&ED eligibility, claim preparation, and audit-readiness strategies. Together, we help clients identify eligible projects, strengthen supporting documentation, and integrate SR&ED planning into their overall tax and funding strategy.

Read more from Elevyn Consulting’s SR&ED insights.

Example: Financing a $200,000 equipment investment

Many small manufacturers finance new equipment instead of paying in cash. The 2025 Budget’s changes — especially immediate expensing and SR&ED eligibility on capital assets — dramatically improve the after-tax cash flow in the first year.

Assumptions

- Equipment cost: $200,000

- SR&ED-eligible portion: $100,000

- Financing: 100 percent loan over 5 years at 7 percent interest (≈ $48,700 annual payment)

- Corporate tax rate: 11 percent (Small Business Deduction)

- SR&ED refundable credit: 35 percent

Before Budget 2025

Under the old rules:

- Only half the normal CCA deduction was allowed in the first year (≈ 15 percent).

- $200,000 × 15% = $30,000 deduction → $30,000 × 11% = $3,300 tax savings.

- No SR&ED credit on equipment.

- Annual loan payment = $48,700.

Net Year 1 cash flow: $3,300 (tax savings) − $48,700 (loan payment) = $45,400 outflow.

After Budget 2025

Under the new measures:

- Full 100 percent immediate deduction on the $200,000 purchase → $22,000 tax savings.

- SR&ED credit for $100,000 used in R&D → $35,000 refundable credit.

- Annual loan payment remains $48,700.

Net Year 1 cash flow: $22,000 (tax savings) + $35,000 (SR&ED credit) − $48,700 (loan payment) = $8,300 net inflow.

Five-year comparison

| Pre-Budget 2025 | Post-Budget 2025 | Improvement | |

| Year 1 net cash flow | – $45,400 | + $8,300 | + $53,700 |

| Five-year cumulative benefit (from accelerated deductions + SR&ED) | ≈ $17,500 | $57,000 | + $39,500 |

Conclusion

By combining financing with immediate expensing and SR&ED credits, a business can turn what used to be a negative cash-flow investment into a positive one in Year 1. That means stronger liquidity, faster payback, and greater flexibility to reinvest in growth or reduce debt.

Contact us today to model these outcomes — showing how tax measures, financing structure, and investment timing can work together to improve overall cash flow and long-term return on investment.