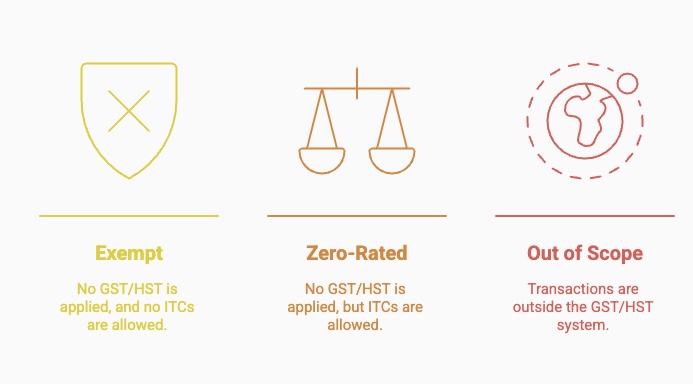

When it comes to GST/HST in Canada, not all goods and services are treated the same. Some are taxable at the full rate, some are taxed at 0%, and some are not subject to GST/HST at all. The terms exempt, zero-rated, and out of scope come up often in bookkeeping and accounting, and while they may sound similar, they carry very different implications for your business.

What Does “Exempt” Mean in Tax?

Exempt supplies are goods and services that are not subject to GST/HST, and you cannot claim Input Tax Credits (ITCs) on related purchases. This means if your business provides exempt services, you don’t charge GST/HST, and you can’t recover the GST/HST paid on your expenses related to that revenue.

Examples of exempt supplies in Canada include:

- Residential rent

- Most health, dental, and medical services

- Child care services

- Educational services (like tutoring in subjects normally taught in school)

What Does “Zero-Rated” Mean in Tax?

Zero-rated supplies are goods and services that are taxable at 0%. While you don’t charge GST/HST on these sales, the key difference is that you can still claim ITCs on related expenses.

Examples of zero-rated supplies in Canada include:

- Basic groceries (milk, bread, vegetables)

- Prescription drugs

- Certain medical devices (hearing aids, pacemakers)

- Exports of goods and services outside Canada

What Does “Out of Scope” Mean in Tax?

Out of scope means a transaction is completely outside the GST/HST system. These are items that don’t fall under taxable or exempt categories because they’re not considered supplies for GST/HST purposes.

Examples of out of scope items include:

- Bank account transfers

- Shareholder loan repayments

- Salary and wages

- Dividends paid to shareholders

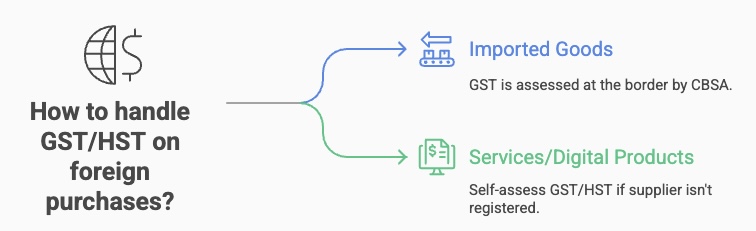

What About Purchases and Sales Outside Canada?

Sales to customers outside Canada are generally zero-rated. You don’t charge GST/HST on these invoices, but you can still claim ITCs on the Canadian expenses used to earn that revenue.

For purchases from foreign suppliers, things depend on the type of expense. Imported goods are typically assessed GST at the border by the Canada Border Services Agency. For services or digital products, you may need to self-assess GST/HST on your return if the supplier isn’t registered for GST/HST in Canada. In QuickBooks Online, these transactions are often recorded as out of scope, but you may still need to adjust your GST return to capture the tax owing.

Difference Between Exempt, Zero-Rated, and Out of Scope

Not quite. Both result in no GST/HST being charged to the customer, but the treatment of expenses is different:

- Zero-rated: You can still claim ITCs.

- Exempt: You cannot claim ITCs.

This difference directly impacts your GST/HST return and cash flow.

| Category | GST/HST Charged on Sale? | ITCs on Related Purchases? | Typical Examples (Canada) | How to Record in QBO |

| Exempt | No | No | Residential rent, health services, child care, education | Use Exempt tax code |

| Zero-Rated | No (0% rate) | Yes | Basic groceries, prescription drugs, exports | Use Zero-Rated tax code |

| Out of Scope | No | N/A (outside system) | Payroll, bank transfers, dividends, loan repayments | Use Out of Scope tax code |

This table makes it easier to see how each category affects both sales and purchases, and how to record them properly in QBO.

Why is it Important to Record Correctly?

If you mix up exempt, zero-rated, or out of scope transactions, you could:

- Overstate or understate ITCs on your GST return

- Trigger CRA reviews or audits

- Misstate your financial results

Accurate coding ensures your GST/HST filings in Canada are correct and you don’t pay penalties or lose out on recoverable taxes.

How Do I Record Correctly in QBO?

In QuickBooks Online (QBO), you can assign the proper Sales Tax Codes to each transaction:

- Exempt – For exempt items (no GST/HST, no ITCs).

- Zero-Rated – For zero-rated items (no GST/HST, ITCs allowed).

- Out of Scope – For transactions outside GST/HST (wages, transfers, many foreign purchases).

If recorded correctly, you can then rely on the Sales Tax feature in QBO to efficiently prepare your GST return. If entries are miscoded, the data in your return will be inaccurate, and your accountant may need to spend extra time cleaning up the records and manually calculating the GST return.

What’s the Difference Between Tax Codes on Purchases and Sales in QBO?

In QBO, tax codes apply differently depending on whether you’re entering a sale or a purchase.

- On sales transactions (invoices, sales receipts), the tax code determines how much GST/HST you charge your customer and how the revenue is reported on your GST return.

- On purchases (bills, expenses, or bank feed entries), the tax code determines whether GST/HST is recorded as an Input Tax Credit (ITC), or whether the transaction is exempt, zero-rated, or out of scope.

For example, coding a client invoice as zero-rated ensures you don’t charge GST but still recognize the sale correctly on your return. On the other hand, coding an office supply purchase as taxable allows QBO to track the GST you paid so you can claim it back as an ITC.

How Can I Improve My Bookkeeping?

Setting up your bookkeeping system properly helps prevent mistakes with GST/HST and saves time at month-end and year-end.

Steps You Can Take:

- Set default tax codes in Products and Services – Assign the correct tax code (exempt, zero-rated, taxable) to each item so invoices and bills calculate correctly every time.

- Set default tax codes for each customer – Apply a customer’s default tax setting once (e.g., exports, province-specific rates) to avoid mistakes.

- Set default tax codes in the Chart of Accounts – Ensure common expenses like rent, insurance, and utilities always use the right code.

- Set up bank rules with tax codes – Automate recurring expenses from the bank feed with the proper tax codes.

- Use a receipt management app like Dext – Extract GST/HST directly from receipts and bills to reduce errors and capture all ITCs.

With these safeguards in place, your books will be cleaner, your GST/HST return more accurate, and your accountant will spend less time correcting mistakes.

How Can I Confirm My Sales Tax Number is Correct?

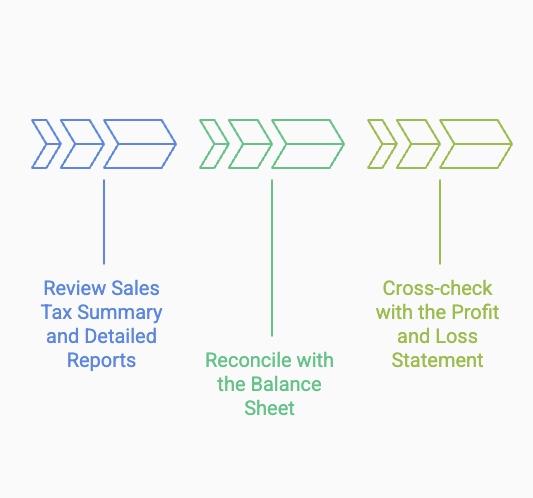

Before filing your GST/HST return, it’s important to confirm the numbers are accurate. QBO gives you a few built-in checks that can help you spot errors:

- Review the Sales Tax Summary and Detailed Reports – Look for consistency month to month. If your sales are steady, your GST collected should also be steady. Similarly, if your expenses are consistent in amount and category, your ITCs should follow a similar pattern. Payroll, bank transfers, shareholder loans, and dividends should appear as out-of-scope with no GST.

- Reconcile with the Balance Sheet – Compare the sales tax balance in the summary report to the GST payable account on your Balance Sheet. These should match; if they don’t, there may be coding errors.

- Cross-check with the Profit and Loss Statement – Compare revenues in the sales tax report to revenues in your profit and loss statement. If there’s a mismatch, some transactions may be coded incorrectly for tax.

These checks won’t guarantee perfection, but they help catch common mistakes before your return is filed.

Real-World Scenarios: How Different Businesses Handle Sales Tax

Consultant Scenario

A management consultant works mostly with Canadian clients but occasionally invoices a U.S. customer. They subcontract some of their work to a Canadian-based consultant, rent an office in Canada, pay for phone and internet, incur interest charges on a business loan, and pay themselves dividends.

| Transaction | Tax Code in QBO | Notes |

| Invoice to Canadian client | Taxable (GST/HST) | GST/HST collected and remitted |

| Invoice to U.S. client | Zero-Rated | Export of services; no GST charged, but ITCs allowed |

| Payment to Canadian subcontractor | Taxable (ITC available) | GST/HST paid can be claimed as ITC |

| Office rent | Taxable (ITC available) | Commercial rent subject to GST/HST |

| Telephone & internet | Taxable (ITC available) | Service providers charge GST/HST |

| Bank loan interest | Exempt | Financial services are exempt; no ITCs |

| Dividend paid to self | Out of Scope | Dividends are not subject to GST/HST |

Restaurant Scenario

A restaurant serves dine-in and take-out customers in Canada. All sales to customers are taxable. On the expense side, the restaurant purchases food, packaging, and supplies, pays salaries to staff, and the owner pays herself a monthly salary.

| Transaction | Tax Code in QBO | Notes |

| Meals sold to customers | Taxable (GST/HST) | GST/HST charged on sales |

| Food and ingredients | Zero-Rated | Basic groceries are zero-rated; no GST charged, but ITCs allowed on other taxable purchases |

| Packaging supplies | Taxable (ITC available) | Supplier charges GST/HST |

| Salaries to staff | Out of Scope | Wages are not subject to GST/HST |

| Owner salary | Out of Scope | Payroll is outside GST/HST system |

These examples highlight how different Canadian business models encounter exempt, zero-rated, taxable, and out-of-scope transactions — and why using the correct QBO tax codes is critical.

What Happens if I Record Incorrectly?

If transactions are miscoded, you might:

- Claim ITCs you’re not entitled to (leading to CRA repayment + interest)

- Fail to claim ITCs you are entitled to (losing cash)

- Report sales incorrectly, inflating or reducing your GST payable

In other words, you’re either leaving money on the table by underclaiming ITCs and overpaying GST, or you’re underpaying GST by underreporting sales tax collected and/or over-reporting ITCs. Either way, it’s a costly mistake that can trigger CRA scrutiny.

Conclusion

Understanding the difference between exempt, zero-rated, and out of scope is essential for accurate bookkeeping and GST/HST compliance in Canada. Recording transactions properly in QuickBooks Online not only saves time but also ensures your sales tax filings are correct, reducing the risk of errors, penalties, or missed ITCs. With the right setup and regular review, your GST/HST reporting can be efficient, accurate, and stress-free.

Need help cleaning up your books or setting up QBO properly? Contact us today!