Are you leaving money on the table when it comes to your business taxes? Many Canadian small business owners miss out on valuable tax savings and financial opportunities by overlooking deductions, credits, and strategic planning.

From unclaimed business expenses and input tax credits to underused tax incentives and inefficient payroll structures, small gaps can add up to significant costs. Running a business is challenging enough—being proactive and working with a tax professional can help you avoid common mistakes, reduce your tax burden, and keep more cash in your business. Let’s dive in to look at where business owners often miss opportunities and how to fix them.

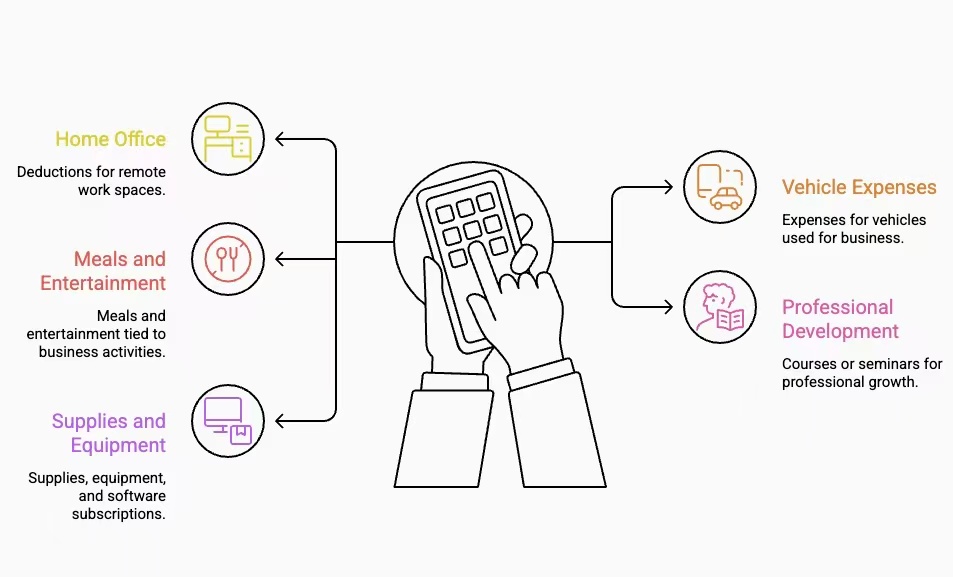

Not Claiming All Eligible Business Expenses

Small business owners can deduct numerous business-related expenses, but many forget to track or claim them. Some examples include:

- Home office deductions for remote work.

- Vehicle expenses used for business purposes.

- Meals and entertainment tied to business activities.

- Professional development, like courses or seminars.

- Supplies, equipment, and software subscriptions.

Missing Out on Input Tax Credits (ITCs)

If you’re registered for GST/HST, you can claim ITCs for the GST/HST paid on eligible business purchases. Forgetting these claims means paying more taxes than necessary.

Overlooking Capital Cost Deductions

Assets like vehicles, equipment, and machinery can be depreciated over time, allowing for capital cost allowances. Don’t forget deductions for building or leasehold improvements, either.

Skipping the Small Business Deduction

Canadian-controlled private corporations (CCPCs) benefit from the Small Business Deduction (SBD), which reduces the tax rate to as low as 9% on the first $500,000 of active business income. Proper incorporation can help you access this.

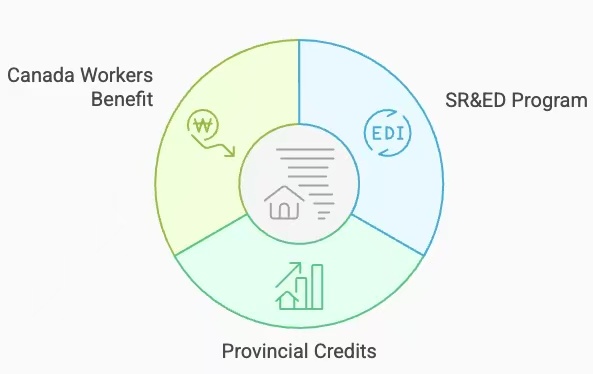

Ignoring Tax Credits

Canada offers a range of tax credits, including:

- Scientific Research and Experimental Development (SR&ED) for businesses involved in R&D.

- Provincial credits, like innovation or hiring incentives.

- Canada Workers Benefit (CWB) for personal tax relief for you and employees.

Not Considering Incorporation

Incorporating your business can lower taxes, defer income, and reduce personal tax liabilities. This strategy becomes particularly useful for higher-income earners.

Overlooking Retirement Planning

Tax-efficient retirement plans like Individual Pension Plans (IPPs) or Registered Retirement Savings Plans (RRSPs) allow business owners to save for the future while reducing taxable income.

Misunderstanding the GST/HST Exemption

Small businesses earning less than $30,000 annually are exempt from charging GST/HST. However, skipping GST/HST registration also means losing access to ITCs on business purchases.

Inefficient Payroll and Compensation Structures

Balancing salary and dividends can optimize your tax liability. A well-thought-out compensation plan can prevent overpaying personal taxes.

Not Leveraging Family Employment

Employing family members legally allows income splitting, reducing the overall tax burden for your household.

Ignoring Tax Deferral Opportunities

Tax deferral strategies, such as leaving profits in the corporation or using life insurance policies, can improve cash flow and minimize taxes.

Skipping Professional Financial Help

DIY bookkeeping and tax filings may save money upfront but can lead to missed opportunities. Partnering with an accountant or tax professional ensures compliance and maximized savings.

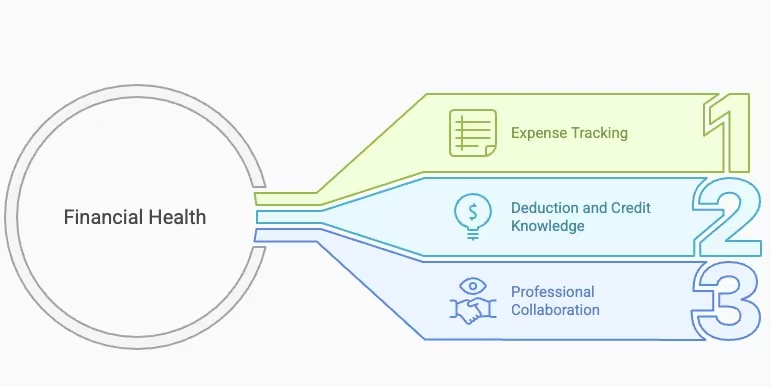

How to Avoid These Mistakes

To keep more of your hard-earned money, consider these steps:

- Track and organize all business expenses meticulously.

- Learn about deductions and credits available to your business type.

- Work with a qualified accountant or tax advisor.

Conclusion

Don’t navigate the complexities of small business taxes alone. Contact us today to learn how our financial experts can help you maximize deductions and minimize tax burdens, so you can focus on growing your business!